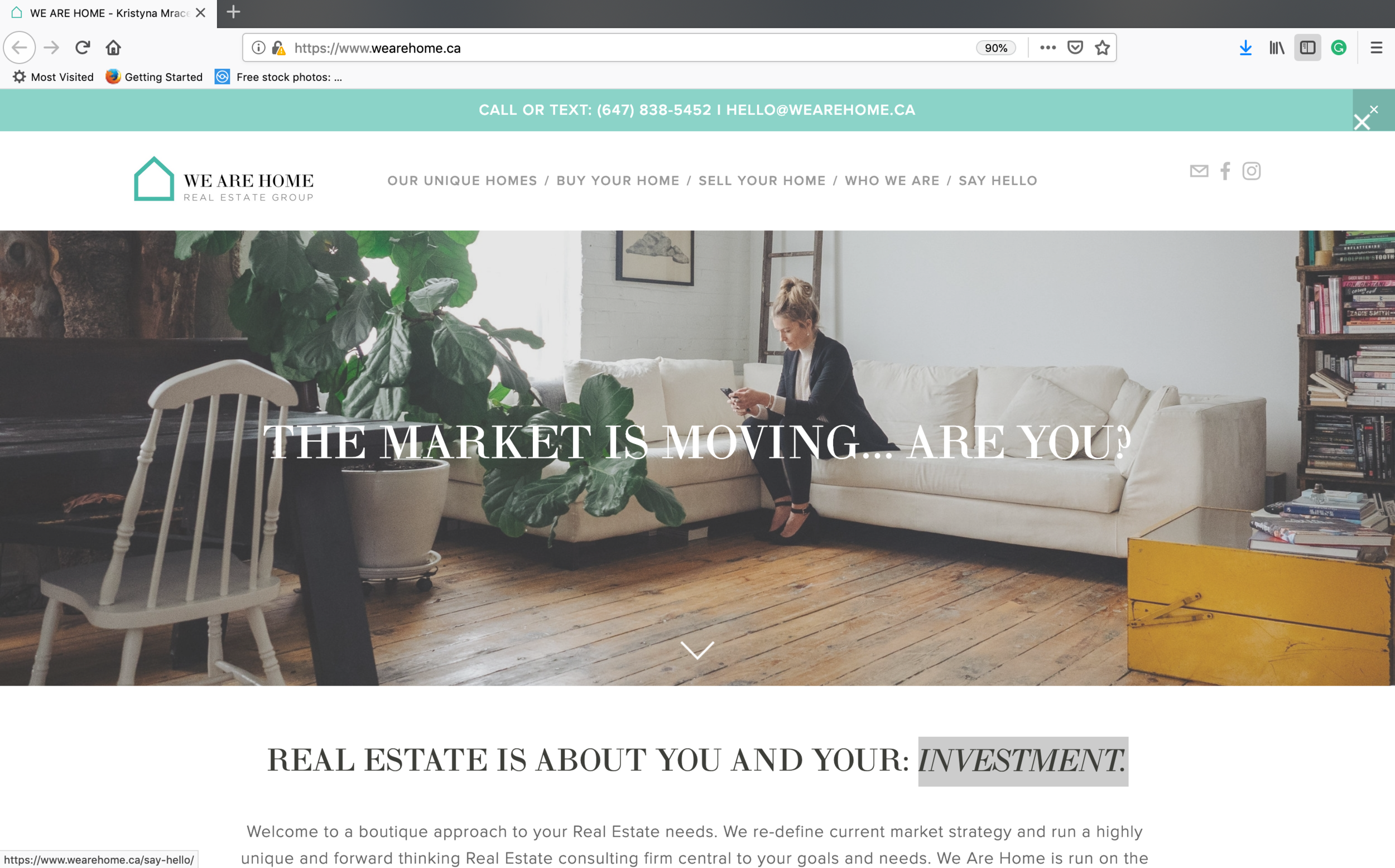

REAL ESTATE IS ABOUT YOU AND YOUR: GOALS. LIFESTYLE. INVESTMENT. WEALTH. HAPPINESS. FAMILY. PETS.

Welcome to a boutique approach to your Real Estate needs. We re-define current market strategy and run a highly unique and forward thinking Real Estate consulting firm central to your goals and needs. We Are Home is run on the fuel of unique properties and years of diligent experience in the Real Estate industry. We have been in the thick of it for our clients and have negotiated successful deals in investing, buying, selling and creating real estate wealth.

We believe in dedication to your needs.

HOW WE COMPARE

TAILORED MARKETING & STRATEGY

The market changes and we change with it. Not every market condition and home deserves the same market strategy. Our bespoke combination of effective selling tools is based around creating a home for every potential buyer.

PORTFOLIO

36-145 Long Branch Ave

ALMOST 1,300 SQ.FT, 3 BED, 3 BATH, CORNER UNIT, WRAPAROUND VERANDA AND TERRACE

2501-11 Charlotte St

1 BED, 1 BATH, 516 SQ.FT + 171 SQ. FT BALCONY, SOFT LOFT W/EXPOSED CONCRETE

306-3563 Lake Shore Rd

1 BED + TRUE SIZED DEN, 755 SQ.FT, SOUTH AND PRIVATE VIEW, 1 PARKING, 1 LOCKER

1065 Concession 3 Rd

+/-28.5 ACRES, CUSTOM-BUILT HOME WITH ~24 ACRES OF AN INCOME-PRODUCING VINEYARD

173 Rankin Cres

3 BED, 3 BATH, 2,074 SQ.FT TOTAL LIVING SPACE, SEMI-DETACHED, 1.5 GARAGE PARKING

81 Euclid Ave

3 BED, 3 BATH, DETACHED GARAGE WITH LANEWAY HOUSE INVESTMENT POTENTIAL

1581 Concession 2 Rd

22.58 ACRES, POTENTIAL ESTATE WINERY POTENTIAL, HISTORIC HOMESTEAD

94 Dewson Street

4 BED, 3 BATH, 2,748 SQ.FT TOTAL LIVING SPACE, LEGAL PARKING PAD, 30 X 75 FT LOT

1604-223 Webb Dr

2 BED + DEN, 2 BATH, 1,032 SQ.FT INTERIOR & 113 SQ.FT BALCONY, 1 PARKING, 1 LOCKER

2512 Fifth St. Louth

100 ACRE PARCEL, +/- 50 ACRES OF VINEYARD, RESIDENTIAL BUILDING AND 3 BARNS

1918 Forks Of The Credit

4 BED, 5 BATH, 6.813 ACRES, OVERLOOKING THE NIAGARA ESCARPMENT

2-4194 Longmoor Dr

3 BED, 2 BATH, 1,534 SQ.FT, CONDO TOWNHOME, PRIVATE BACKYARD

FOLLOW US FOR A PEEK AT LIFE IN UNIQUE PROPERTIES

A year after our clients close on their property, we send a 'home anniversary' 🏡 email and break down how the market has paced relative to their purchase. These timely updates give our clients a better understanding of their investment and allow them to explore options throughout their term.

Yes, the market is not always predictable. Yes, the market is forever changing.

We always recommend looking at your purchase as a long-term investment (typically 5 years). In an active market, you can take advantage of unprecedented market gains and potentially withdraw up to 80% of your appreciation to use towards a new investment.

Mark, a client of ours, did just that and purchased a pre-construction unit, and our client Emma used her appreciation to start her own small business.

In June 2019, we assisted another one of our clients in selling a loft in downtown Toronto and purchase an off-market detached bungalow in Burlington. Our client followed our advice and invested in a neighbourhood that was positioned for a healthy level of gentrification in the next 5 years on a builder sized lot of 60'x120' for $633,000.

Within 8 months, our client realized a minimum of $140,000 in gross profits without any significant investment back into his home.

This appreciation is not a fluke but a carefully crafted plan to utilize our client's buying power and create a strategy built around short and long term goals.

Each one of our clients comes to us with a different subset of requirements, and we don't sell. We assure our clients in their purchase by identifying the most critical elements to them and pairing that with the right investment.

Are you looking to sell your Toronto loft or condo and move outside of the city? We are eager to discuss all of your options and help breakdown all financials associated with the next step in your real estate journey.

-

Have a Real Estate question or interested in chatting more? DM or email us!

📩 Hello@WeAreHome.ca

We are happy to help guide you towards building smart wealth through your real estate journey.

Last week we posted that the Bank of Canada is set to hold the key target rate at 1.75%. Here are 4 creative ways you can take advantage of BoC’s announcement!

-

Have a Real Estate question?

DM or email us!

✉️ Hello@WeAreHome.ca

We are happy to help guide you towards building smart wealth through your real estate journey.

Have a mortgage question?

✉️ kirk.eaton@premieremortgage.ca

“Move fast and break things”

Sheryl Sandberg referenced that psychologists have found that over time we usually regret the chances we missed, no the chances we took. She also spoke about Mark Zuckerberg’s now-famous motto: “Move fast and break things.” A motto that speaks of making mistakes is a natural consequence of innovation.

To me, it is my idea of failing often and learning with each setback. The focus of moving past that paralysis we can feel when we are afraid to make that next move, in any aspect of life.

MORTGAGE RATE UPDATE 📈

Bank of Canada holds the key target rate at 1.75%

What does this mean for you? Here are 4 creative ways you can utilize these low rates:

1️⃣INCREASE YOUR MORTGAGE PAYMENTS

Any additional payment that you make above your regular payment goes straight to principal, and small increases can make a huge difference.

2️⃣PLACE EXTRA $ TOWARDS SAVINGS OR RETIREMENT

Consider putting that extra money towards your RSP, TFSA or even start a non-registered investment portfolio and make your mortgage tax-deductible.

3️⃣CONSOLIDATED DEBT

When done correctly can make a massive impact on your financial situation.

4️⃣HOME RENOVATIONS

Taking advantage of lower interest rates allows you to get the money you need to renovate without breaking the bank.

Information provided by Kirk Eaton

-

Have a Real Estate question? DM or email us!

✉️ Hello@WeAreHome.ca

We are happy to help guide you towards building smart wealth through your real estate journey.

Have a mortgage question?

✉️ kirk.eaton@premieremortgage.ca

@kirk_el_capitan

Yeeesss… the market is shifting AND it’s much-needed relief for buyers and a more healthy seller’s market.

Without dispute, there has been a softening happening across the board. In general, homes are selling for less than peak February numbers… yet, there is still less than 1 month of inventory in the 905 and 416 markets and prices are still up on average 15% year-over-year.

𝗛𝗘𝗥𝗘 𝗔𝗥𝗘 𝗔 𝗖𝗢𝗨𝗣𝗟𝗘 𝗢𝗙 𝗡𝗢𝗧𝗔𝗕𝗟𝗘 𝗧𝗔𝗞𝗘-𝗔𝗪𝗔𝗬𝗦:

▪️In the city of Toronto, prices of freehold properties could drop 3-5% by the summer from February’s peak.

▪️Condos under $800,000 will still be a target as they continue to be the most affordable type of housing for first-time homebuyers.

▪️Some suburban markets in the GTA could see a price decrease of 10-20%.

▪️Townhomes will continue to see a decline as they were the most overvalued type of housing throughout the last 1.5 years. We have seen a dramatic pullback by buyers to the tune of a 22% depreciation from February 1 - April 19.

▪️Condos only dipped 6.8%.

But here is the thing, buying in the same market is relative and we always encourage a long-term buying strategy as real estate is a liquid asset and requires a long-term outlook.

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗢𝗣𝗘𝗡 𝗛𝗢𝗨𝗦𝗘✨

Join us for a 𝗽𝘂𝗯𝗹𝗶𝗰 𝗼𝗽𝗲𝗻 𝗵𝗼𝘂𝘀𝗲 this 𝗦𝗔𝗧𝗨𝗥𝗗𝗔𝗬 and 𝗦𝗨𝗡𝗗𝗔𝗬 from 𝟮:𝟬𝟬-𝟰:𝟬𝟬𝗣𝗠 at 𝟮𝟮𝟯 𝗪𝗘𝗕𝗕 𝗗𝗥𝗜𝗩𝗘.

ESSENTIALS

▪️2 bedroom + den I 2 bathroom

▪️1,032 sq.ft interior + 113 sq.ft balcony

▪️Private eastern and southern views

▪️Offered at: $915,000

DM us for more details!

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at condo living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗡𝗘𝗪 𝗧𝗢 𝗠𝗔𝗥𝗞𝗘𝗧✨

Clarkson Urban Towns - a brand new townhome community in Clarkson and a residential haven for urban life!

ESSENTIALS

▪️2 bedroom I 2+1 bathroom

▪️965 sq.ft interior + TWO 54 sq.ft balconies

▪️1 parking I 1 locker

▪️Available immediately

▪️Lease rate: $2,800/month

DM us to book a private tour!

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at townhome living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗡𝗘𝗪 𝗧𝗢 𝗠𝗔𝗥𝗞𝗘𝗧✨

Fully renovated with tons a privacy and protected southern views!

ESSENTIALS

▪️2 bedroom + den I 2 bathroom

▪️1,032 sq.ft interior + 113 sq.ft balcony

▪️1 parking I 1 locker

▪️Condo fees: $836.87/month

▪️Condo fees include: heat, water, building insurance

More details - 223WebbDrive-1604.ca

DM us to book a private tour!

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at condo living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗡𝗘𝗪 𝗧𝗢 𝗠𝗔𝗥𝗞𝗘𝗧✨

A not-so-humble abode comes complete with elegant renovations and black accented finishes. A corner unit to blow the socks off any light-lover with floor-to-ceiling windows and 2-point access to the balcony, where you will find the stillness of a panoramic southeast view.

𝗘𝗦𝗦𝗘𝗡𝗧𝗜𝗔𝗟𝗦

▪️2 bedroom + den I 2 bathroom

▪️1,032 sq.ft interior + 113 sq.ft balcony

▪️1 parking I 1 locker

▪️Condo fees: $836.87/month

▪️Condo fees include: heat, water, building insurance

𝗢𝗙𝗙𝗘𝗥𝗘𝗗 𝗔𝗧: $799,000

Get the details - 223WebbDrive-1604.ca

DM us to book a private tour!

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at condo living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗕𝗨𝗕𝗕𝗟𝗘 𝗧𝗛𝗘𝗢𝗥𝗬✨

The GTA housing market has historically performed with resiliency and on average, consistent appreciation. Last year, the average price was up 17.8% to just under $1.1MM and this year the Toronto Real Estate Board is projecting the average sale price to jump by 12%.

In this video we chat about what bearing Bubble Theory has on our 𝙫𝙚𝙧𝙮… 𝙫𝙚𝙧𝙮 hot market!

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗡𝗘𝗪 𝗧𝗢 𝗠𝗔𝗥𝗞𝗘𝗧✨

Let spring hit you hard at Broadview Lofts. Built on the original grounds of Toronto’s first baseball stadium, this warehouse hard loft knocks it out of the park.

Renovated authentic loft circa 1914 with 10’ ceilings, concrete floors and original industrial steel doors.

ESSENTIALS

▪️1 bedroom I 1 bathroom

▪️1,022 sq.ft

▪️1 parking I 1 locker

▪️Excluding: hydro utility

▪️Listed for Lease: $3,700/month

Contact @_wearehome for more details and to book a private tour.

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at Toronto living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗠𝗢𝗡𝗘𝗧𝗔𝗥𝗬 𝗣𝗢𝗟𝗜𝗖𝗬 𝗨𝗣𝗗𝗔𝗧𝗘✨

Bank of Canada (BoC) increased it's overnight lending rate, which was well anticipated considering inflation hit a 30 year high.

Here is what this means for your variable rate mortgage and/or home equity line of credit:

𝗛𝗢𝗠𝗘 𝗘𝗤𝗨𝗜𝗧𝗬 𝗟𝗜𝗡𝗘 𝗢𝗙 𝗖𝗥𝗘𝗗𝗜𝗧 (𝗛𝗘𝗟𝗢𝗖): For every $100,000 balance on a HELOC you will be paying approximately an additional $21/month in interest.

𝗩𝗔𝗥𝗜𝗔𝗕𝗟𝗘/𝗔𝗗𝗝𝗨𝗦𝗧𝗔𝗕𝗟𝗘 𝗥𝗔𝗧𝗘 𝗠𝗢𝗥𝗧𝗚𝗔𝗚𝗘: For every $100,000, a 0.25% rate increase equates to roughly a $12/month increase. For example, on a $500,000 mortgage your payment will increase by roughly $58/month so please don't panic!

**If you are with TD or HSBC, your payment will remain static and not change.

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

Image: sfgirlbybay.com

✨𝗡𝗘𝗪 𝗧𝗢 𝗠𝗔𝗥𝗞𝗘𝗧✨

This former CBC prop warehouse circa 1956 was built on part of the old Dominion Brewery that was built in 1878, with the Dominion Hotel following in 1889. The hotel remains as the Dominion Pub still open today, and a go-to place for live jazz and blues!

𝗘𝗦𝗦𝗘𝗡𝗧𝗜𝗔𝗟𝗦

▪️1 bedroom + den I 1 bathroom

▪️1,323 sq.ft

▪️1 parking I 1 locker

▪️$755.22/month condo fees

▪️Industrial live/work loft

𝗢𝗙𝗙𝗘𝗥𝗘𝗗 𝗔𝗧: $1.099MM - Offers presented on March 07

Contact @_wearehome for more details and to book a private tour.

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at Toronto living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

-

Listed @hillary.lane

𝗠𝗢𝗡𝗘𝗧𝗔𝗥𝗬 𝗣𝗢𝗟𝗜𝗖𝗬 𝗨𝗣𝗗𝗔𝗧𝗘✨

All eyes have been glued on the Bank of Canada as interest rates are expected to rise 4-6X in the next year. Inflation is at a record 30-year high at 4.8%. The last time our inflation was this high, the overnight rate was near 10% and not… 0.25%!

In this video we discuss why tracking the overnight rate trajectory is essential as it directly impacts variable mortgage rates and HELOC loans.

We also look at the opportunities that low-interest rates can 𝙨𝙩𝙞𝙡𝙡 offer!

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗧𝗵𝗲 𝗼𝘃𝗲𝗿𝗻𝗶𝗴𝗵𝘁 𝗿𝗮𝘁𝗲 𝗶𝘀... 𝙉𝙊𝙏 𝗶𝗻𝗰𝗿𝗲𝗮𝘀𝗶𝗻𝗴 𝗳𝗼𝗿 𝗻𝗼𝘄!✨

Bank of Canada announced today that they are maintaining their overnight rate, which means the target rate is holding at 0.25%.

𝗪𝗵𝗮𝘁 𝗱𝗼𝗲𝘀 𝘁𝗵𝗶𝘀 𝗺𝗲𝗮𝗻? 🤔

Your interest rates will not increase.

Expect 𝘯𝘰 𝘤𝘩𝘢𝘯𝘨𝘦𝘴 to your variable rate mortgage OR HELOC.

… this may change as early as the following schedule announcement on March 2.

𝗪𝗵𝗮𝘁 𝗰𝗮𝗻 𝘄𝗲 𝗲𝘅𝗽𝗲𝗰𝘁 𝘄𝗶𝗹𝗹 𝗵𝗮𝗽𝗽𝗲𝗻 𝗶𝗻 𝟮𝟬𝟮𝟮?

Experts still believe we will likely see 4 more rate hikes in the next year… albeit these predictions come from the same people who predicted a rate hike today.

𝗜𝗳 𝘆𝗼𝘂 𝗰𝘂𝗿𝗿𝗲𝗻𝘁𝗹𝘆 𝗵𝗮𝘃𝗲 𝗮 𝘃𝗮𝗿𝗶𝗮𝗯𝗹𝗲 𝗺𝗼𝗿𝘁𝗴𝗮𝗴𝗲, 𝘆𝗼𝘂 𝗺𝗮𝘆 𝗯𝗲 𝘄𝗼𝗻𝗱𝗲𝗿𝗶𝗻𝗴 𝗵𝗼𝘄 𝘁𝗵𝗲𝘀𝗲 𝗲𝘅𝗽𝗲𝗰𝘁𝗲𝗱 𝗿𝗮𝘁𝗲 𝗶𝗻𝗰𝗿𝗲𝗮𝘀𝗲𝘀 𝗰𝗮𝗻 𝗶𝗺𝗽𝗮𝗰𝘁 𝘆𝗼𝘂𝗿 𝗺𝗼𝗿𝘁𝗴𝗮𝗴𝗲 𝗮𝗻𝗱 𝗶𝗳 𝘆𝗼𝘂 𝘀𝗵𝗼𝘂𝗹𝗱 𝗹𝗼𝗰𝗸 𝘆𝗼𝘂𝗿 𝘃𝗮𝗿𝗶𝗮𝗯𝗹𝗲 𝗿𝗮𝘁𝗲 𝗶𝗻𝘁𝗼 𝗮 𝗳𝗶𝘅𝗲𝗱 𝗿𝗮𝘁𝗲.

“As of right now you would be paying a large premium as some spreads between a variable and fixed are as high as 1.75%. Also, keep in mind your variable rate mortgage is more flexible in terms of penalties with only a 3 months interest penalty.” Kirk Eaton Mortgage

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

$𝟮𝟬 𝗠𝗜𝗟𝗟𝗜𝗢𝗡

Hi! Happy New Year to you all! 🥳

Year over year, I have set out ongoing and constant changes to better the overall experience for my clients. Each interaction and sale is re-evaluated, and I always ask; what went well and what didn’t work. The ‘didn’t work’ keeps me improving. I focus on self-development and fine-tune the systems in place - stacking these improvements and being critical and deliberate.

2021 was a year unlike the rest, I sold $20MM in real estate last year, and no one deserves a bigger thank you than our support. Our extended team of professionals (that are SO damn good at what they do!). Our clients that have allowed us the privilege to earn their trust and advocate for their best interests every step of the way. And to our referral network and kind advocates.

It’s a privilege to grow this business in the way that I have, alongside so many people I am forever grateful to call my support system.

❤️

𝗠𝗢𝗥𝗧𝗚𝗔𝗚𝗘 𝗥𝗔𝗧𝗘𝗦 𝗔𝗥𝗘 𝗢𝗡 𝗧𝗛𝗘 𝗠𝗢𝗩𝗘 ✨

Expectations are pointing to a rise in fixed and variable rates. Contrary to previous expectations that rates would hold until 2023 we are already experiencing rate increases. The Bank of Canada could hike its benchmark interest rate at least six times in early 2022.

𝗪𝗛𝗔𝗧 𝗖𝗢𝗨𝗟𝗗 𝗧𝗛𝗜𝗦 𝗠𝗘𝗔𝗡 𝗙𝗢𝗥 𝗬𝗢𝗨?

▪️𝗜𝗳 𝘆𝗼𝘂 𝗮𝗿𝗲 𝘁𝗵𝗶𝗻𝗸𝗶𝗻𝗴 𝗮𝗯𝗼𝘂𝘁 𝗽𝘂𝗿𝗰𝗵𝗮𝘀𝗶𝗻𝗴 𝗿𝗲𝗮𝗹 𝗲𝘀𝘁𝗮𝘁𝗲, consider bringing up your timeline and purchasing under your current means. If you can’t afford a mortgage that is 200 basis points or 2% higher than current rates, buy a smaller property!

▪️𝗜𝗳 𝘆𝗼𝘂 𝗮𝗿𝗲 𝗮 𝗵𝗼𝗺𝗲𝗼𝘄𝗻𝗲𝗿 𝗮𝗻𝗱 𝗹𝗼𝗼𝗸𝗶𝗻𝗴 𝘁𝗼 𝗿𝗲𝗳𝗶𝗻𝗮𝗻𝗰𝗲 𝘆𝗼𝘂𝗿 𝗽𝗿𝗼𝗽𝗲𝗿𝘁𝘆 in the next few years, you might be less impacted since Canada was in a higher interest rate environment in 2017 and 2018.

Overall, the impact of higher mortgage rates will likely not affect the housing market and prices all that much. Improved affordability likely won’t be seen since higher inflation is currently offsetting any meaningful wage gains.

The Bank of Canada is set to announce plans for mortgage rates on December 08 - stay tuned! 📣

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

Photo: McGee & Co.

𝗙𝗔𝗟𝗟 𝗠𝗔𝗥𝗞𝗘𝗧 𝗨𝗣𝗗𝗔𝗧𝗘 ✨

𝖡𝖴𝖸𝖤𝖱𝖲 𝖱𝖤𝖢𝖤𝖨𝖵𝖨𝖭𝖦 𝖥𝖨𝖭𝖠𝖭𝖢𝖨𝖠𝖫 𝖦𝖨𝖥𝖳𝖲 𝖥𝖱𝖮𝖬 𝖳𝖧𝖤𝖨𝖱 𝖯𝖠𝖱𝖤𝖭𝖳𝖲

▪️$10 billion dollars was gifted to home buyers in Canada. CIBC reported that 30% of first-time homebuyers received a financial gift, and 2/3 of buyers who received a gift (on average $82,000) said that it was the primary source of their down payments.

𝖲𝖳𝖱𝖤𝖭𝖦𝖳𝖧𝖤𝖭𝖨𝖭𝖦 𝖢𝖮𝖭𝖣𝖮 𝖬𝖠𝖱𝖪𝖤𝖳

▪️The average condo price reported by the Toronto Real Estate Board increased by over 11% year-over-year, which is still trailing in comparison to the townhome, semi-detached and detached market.

▪️In October, condo sales jumped by 71%, buyers and investors are moving into the condo space to take advantage of softer pricing.

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗛𝗢𝗪 𝗗𝗢 𝗬𝗢𝗨 𝗦𝗧𝗔𝗥𝗧 𝗧𝗢 𝗕𝗨𝗜𝗟𝗗 𝗔 𝗥𝗘𝗔𝗟 𝗘𝗦𝗧𝗔𝗧𝗘 𝗣𝗢𝗥𝗧𝗙𝗢𝗟𝗜𝗢?✨

𝗕𝘆 𝘂𝘁𝗶𝗹𝗶𝘇𝗶𝗻𝗴 𝗴𝗼𝗼𝗱 𝗱𝗲𝗯𝘁 (good debt increases your net worth and/or helps you to generate value), so you may leverage the equity in your home to work for you.

𝖸𝖮𝖴 𝖢𝖠𝖭 𝖣𝖮 𝖳𝖧𝖨𝖲 𝖨𝖭 𝖠 𝖥𝖤𝖶 𝖶𝖠𝖸𝖲:

▪️𝗟𝗲𝘃𝗲𝗿𝗮𝗴𝗲 𝘆𝗼𝘂𝗿 𝗰𝘂𝗿𝗿𝗲𝗻𝘁 𝗽𝗿𝗼𝗽𝗲𝗿𝘁𝘆’𝘀 𝗵𝗼𝗺𝗲 𝗲𝗾𝘂𝗶𝘁𝘆 (i.e.borrow that home equity, meaning that mortgage providers will let you refinance or re-draw 80% of the market value of your home) for a nominal, low-interest rate.

▪️𝗨𝘁𝗶𝗹𝗶𝘇𝗶𝗻𝗴 𝗮 𝗛𝗼𝗺𝗲 𝗘𝗾𝘂𝗶𝘁𝘆 𝗟𝗶𝗻𝗲 𝗼𝗳 𝗖𝗿𝗲𝗱𝗶𝘁 (𝗛𝗘𝗟𝗢𝗖): You can then use this HELOC loan by leveraging your home equity to buy another home in Canada or to buy a rental property.

𝗧𝗜𝗣 ✨ The Canada Revenue Agency (CRA) allows you to deduct the interest portion of your investment property mortgage from your taxes!

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

Photo: Cb2

We’re thrilled to announce this Victorian 💎 at 81 Euclid Ave is featured in @storeyspublishing !

Full article is linked in our bio!

“Those who have an eye for style — and who are financially savvy — will be eager to snag a new listing in the Trinity Bellwoods neighbourhood.

Fresh to the market, 81 Euclid Avenue is offering its lucky buyer an immediate return on their investment, plus the benefit of long-term gains thanks to a laneway home building opportunity.”

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗛𝗢𝗪 𝗪𝗜𝗟𝗟 𝗣𝗔𝗥𝗧𝗦 𝗢𝗙 𝗧𝗛𝗘 𝗣𝗥𝗢𝗣𝗢𝗦𝗘𝗗 𝗟𝗜𝗕𝗘𝗥𝗔𝗟 𝗛𝗢𝗨𝗦𝗜𝗡𝗚 𝗣𝗟𝗔𝗡 𝗜𝗠𝗣𝗔𝗖𝗧 𝗬𝗢𝗨✨

We have selected a few notable parts of the plan that may impact your real estate decisions.

We love the introduction of a 𝘁𝗮𝘅-𝗳𝗿𝗲𝗲 𝗙𝗶𝗿𝘀𝘁 𝗛𝗼𝗺𝗲 𝗦𝗮𝘃𝗶𝗻𝗴𝘀 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 that compounds your $ utilizing a blended RRSP and TFSA.

On the other hand, the 𝗛𝗼𝗺𝗲 𝗕𝘂𝘆𝗲𝗿𝘀’ 𝗕𝗶𝗹𝗹 𝗼𝗳 𝗥𝗶𝗴𝗵𝘁𝘀 is a more controversial plan that sounds better than it is.

𝖠 𝖥𝖤𝖶 𝖯𝖠𝖱𝖳𝖲 𝖮𝖥 𝖳𝖧𝖤 𝖡𝖨𝖫𝖫 𝖠𝖱𝖤 𝖠𝖲 𝖥𝖮𝖫𝖫𝖮𝖶𝖲:

𝗢𝗡𝗘

▪️Banning blind bidding - this can’t be unilaterally implemented by the Federal government without provincial buy-ins and cooperation…unless… the act is criminalized.

𝗧𝗪𝗢

▪️Establishing a legal right to a home inspection - buyers can currently conduct a pre-offer inspection even when the property is holding back offers.

𝗧𝗛𝗥𝗘𝗘

▪️Ensuring total transparency on the history of recent house sale prices on title searches - your representation should be providing fulsome sales data at any point during the home buying process.

𝗙𝗢𝗨𝗥

▪️Ensuring banks and lenders offer mortgage deferrals for up to 6 months - as long as this does not impact the mortgagers' creditworthiness.

𝖫𝖤𝖠𝖱𝖭 𝖬𝖮𝖱𝖤 ⬇️

https://liberal.ca/housing/

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

✨NEW TO MARKET✨

𝗘𝗩𝗘𝗥𝗬𝗧𝗛𝗜𝗡𝗚’𝗦 𝗖𝗢𝗠𝗜𝗡𝗚 𝗨𝗣, 𝗘𝗨𝗖𝗟𝗜𝗗!

All levels are utterly renovated with a practical design and curated attention to detail. High ceilings with oh-so much unexpected natural light and adorned with custom millwork, endless integrated closet storage systems and staggering walnut accents. We did say everything was coming up for you!

𝖧𝖨𝖦𝖧𝖫𝖨𝖦𝖧𝖳𝖲

▪️ Victorian townhouse built in 1900

▪️3 bedrooms (or 2 bed + office - built-in storage in the office doubles as closet space!)

▪️3 full bathrooms

▪️14.50 x 130.50 FT lot

▪️Detached single garage with laneway house potential

▪️Private backyard

𝗢𝗙𝗙𝗘𝗥𝗘𝗗 𝗔𝗧: $2.125MM

𝗩𝗜𝗥𝗧𝗨𝗔𝗟 𝗧𝗢𝗨𝗥: www.81EuclidAve.ca

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at luxury living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗪𝗜𝗟𝗟 𝗥𝗘𝗔𝗟 𝗘𝗦𝗧𝗔𝗧𝗘 𝗣𝗥𝗜𝗖𝗘𝗦 𝗗𝗥𝗢𝗣?✨

Good question… and that depends on where we are in the recessionary cycle.

𝖶𝖧𝖠𝖳 𝖶𝖤 𝖤𝖷𝖯𝖤𝖢𝖳 𝖳𝖮 𝖲𝖤𝖤 𝖨𝖭 𝖠 𝖳𝖸𝖯𝖨𝖢𝖠𝖫 𝖱𝖤𝖢𝖤𝖲𝖲𝖨𝖮𝖭

▪️The economy overheats

▪️Consumer and business spending decreases

▪️Rise in unemployment

▪️Weakened real estate

It can take years for all of these sectors to recover.

𝖶𝖧𝖤𝖱𝖤 𝖠𝖱𝖤 𝖶𝖤 𝖨𝖭 𝖳𝖧𝖤 𝖢𝖸𝖢𝖫𝖤? We are recovering… with full force!

“While many economic indicators did decline in March 2020, they rebounded far faster than ever before. For instance, Canada’s unemployment rate reached a pandemic high of 13.7% in May 2020, only to start rapidly declining soon after – it now sits at 7.5%. Housing prices also dropped significantly at first, with sales posting record declines in April 2020. By the end of the year, sales of existing homes were the highest they’ve been in 14 years.

It’s a similar story for stock markets. According to Ned Davis Research, a major stock market drop of between 20% and 40% takes, on average, about 11 months to go from peak to trough and then another 14 months to reach its prior highs. In the last recession, it took six years for the S&P 500 to return to 2007 levels. This time it took a month for the market to fall by about 35% and a mere five months to reach its pre-pandemic peak.”

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

Source: BNN Bloomberg

Photo: CB2

𝗘𝗩𝗘𝗥𝗬𝗧𝗛𝗜𝗡𝗚’𝗦 𝗖𝗢𝗠𝗜𝗡𝗚 𝗨𝗣, 𝗘𝗨𝗖𝗟𝗜𝗗 ✨

All levels are utterly renovated with a practical design and curated attention to detail. 3 bedrooms (or 2 bed and 1 multi-f-u-n-c-t-i-o-n-a-l office), 3 full bathrooms captured by high ceilings and adorned with custom millwork, endless integrated closet storage systems and staggering walnut accents. Hardwood floors, wainscotting, floating walnut vanities, quintessential exterior Victorian accents, heated lower level with NuHeat, and the list goes on. We did say everything was coming up for you!

𝖧𝖨𝖦𝖧𝖫𝖨𝖦𝖧𝖳𝖲

▪️Victorian townhome built in 1900

▪️3 bedrooms (or 2 bed + office - built-in storage in the office doubles as closet space!)

▪️3 full bathrooms

▪️14.50 x 130.50 FT lot

▪️Detached single garage with laneway house potential

▪️Private backyard

𝗢𝗙𝗙𝗘𝗥𝗘𝗗 𝗔𝗧: $1.987MM

𝗩𝗜𝗥𝗧𝗨𝗔𝗟 𝗧𝗢𝗨𝗥: www.81EuclidAve.ca

Photo/video: @myhomeviewer

Staging: @thestaginghouseburlington

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at luxury living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗘𝗩𝗘𝗥𝗬𝗧𝗛𝗜𝗡𝗚’𝗦 𝗖𝗢𝗠𝗜𝗡𝗚 𝗨𝗣, 𝗘𝗨𝗖𝗟𝗜𝗗 ✨

All levels are utterly renovated with a practical design and curated attention to detail. 3 bedrooms (or 2 bed and 1 multi-f-u-n-c-t-i-o-n-a-l office), 3 full bathrooms captured by high ceilings and adorned with custom millwork, endless integrated closet storage systems and staggering walnut accents. Hardwood floors, wainscotting, floating walnut vanities, quintessential exterior Victorian accents, heated lower level with NuHeat, and the list goes on. We did say everything was coming up for you!

𝖧𝖨𝖦𝖧𝖫𝖨𝖦𝖧𝖳𝖲

▪️Classic Victorian built in 1900

▪️3 bedrooms (or 2 bed + office - built-in storage in the office doubles as closet space!)

▪️3 full bathrooms

▪️14.50 x 130.50 FT lot

▪️Detached single garage with laneway house potential

▪️Private backyard

𝗢𝗙𝗙𝗘𝗥𝗘𝗗 𝗔𝗧: $1.987MM

𝗩𝗜𝗥𝗧𝗨𝗔𝗟 𝗧𝗢𝗨𝗥: www.81EuclidAve.ca

Photo/video: @myhomeviewer

Staging: @thestaginghouseburlington

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at luxury living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗞𝗘𝗬 𝗧𝗔𝗞𝗘𝗔𝗪𝗔𝗬𝗦 ✨

𝘾𝙐𝙍𝙍𝙀𝙉𝙏 𝙈𝘼𝙍𝙆𝙀𝙏:

In general, sellers are faced with less overall demand and buyers are facing less upward pressure on prices.

𝘽𝙐𝙔𝙀𝙍𝙎 𝙎𝙃𝙊𝙐𝙇𝘿 𝙏𝘼𝙆𝙀 𝘼𝘿𝙑𝘼𝙉𝙏𝘼𝙂𝙀 𝙊𝙁 𝙏𝙃𝙀 𝙇𝘼𝙏𝙀 𝙎𝙐𝙈𝙈𝙀𝙍 𝙈𝘼𝙍𝙆𝙀𝙏:

1️⃣ Less buyer competition

2️⃣ Softer sale prices

3️⃣ Increased seller motivation

𝙒𝙃𝘼𝙏 𝘾𝘼𝙉 𝙒𝙀 𝙀𝙓𝙋𝙀𝘾𝙏 𝙁𝙍𝙊𝙈 𝙏𝙃𝙀 𝙁𝘼𝙇𝙇 𝙈𝘼𝙍𝙆𝙀𝙏:

1️⃣ More demand in all housing types

2️⃣ Modest appreciation in the freehold sector

3️⃣ Stronger appreciation in the condo sector

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗕𝗨𝗬𝗘𝗥𝗦 ✨

August is an auspicious market for those thinking of buying a property. If you feel tired from a competitive year, 𝙙𝙤 𝙣𝙤𝙩 take a break this month!

𝗣𝗥𝗢𝗦 𝗢𝗙 𝗔 𝗟𝗔𝗧𝗘 𝗦𝗨𝗠𝗠𝗘𝗥 𝗥𝗘𝗔𝗟 𝗘𝗦𝗧𝗔𝗧𝗘 𝗠𝗔𝗥𝗞𝗘𝗧:

1️⃣ Less buyer competition

2️⃣ Softer sale prices

3️⃣ Increased seller motivation

Photo from our listing at 94 Dewson Street, Toronto | www.94DewsonSt.com

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗔𝗳𝗳𝗼𝗿𝗱𝗮𝗯𝗶𝗹𝗶𝘁𝘆… if you don’t own real estate, doesn’t it feel like each time you save your hard-earned dollars the home you have your sights set on jumps up in value and now becomes unaffordable?!

So if you’re renting and thinking, “I’ll buy later” below are some sobering stats.

The National Bank of Canada's latest Housing Affordability monitor, notes Housing affordability worsens by the most in 27 years in Q2 2021.

𝗛𝗢𝗪 𝗖𝗔𝗡 𝗬𝗢𝗨 𝗖𝗔𝗧𝗖𝗛 𝗨𝗣 𝗟𝗘𝗧 𝗔𝗟𝗢𝗡𝗘 𝗚𝗘𝗧 𝗔𝗛𝗘𝗔𝗗? ✨

Don’t get hung up on if the home hits all your wants and 𝙜𝙚𝙩 𝙚𝙭𝙘𝙞𝙩𝙚𝙙 𝙖𝙗𝙤𝙪𝙩 𝙞𝙣𝙫𝙚𝙨𝙩𝙞𝙣𝙜 your $ towards your future instead of lining your landlords pockets.

✖️ The average appreciation of a condo in the city increased by 12.5%/yr from 2015 to 2020 (let’s omit the blip of the pandemic) AND lets air on the side of caution and estimate an average appreciate of 6.25%/yr. Based on a 6.25% appreciation/yr compounded annually, a $650k investment will increase by over $230k in 5 years.

Since your mortgage payments go directly towards your mortgage and interest, and you include your original downpayment, you end up with a net profit of about $366k.

𝗥𝗲𝗻𝘁𝗶𝗻𝗴 𝘄𝗶𝗹𝗹 𝗹𝗲𝗮𝘃𝗲 𝘆𝗼𝘂 - $𝟭𝟯𝟮𝗸, 𝗮𝗻𝗱 𝗼𝘄𝗻𝗶𝗻𝗴 𝘆𝗼𝘂𝗿 𝗳𝗶𝗿𝘀𝘁 𝗽𝗿𝗼𝗽𝗲𝗿𝘁𝘆 𝘄𝗶𝗹𝗹 𝗰𝗿𝗲𝗮𝘁𝗲 $𝟯𝟲𝟲𝗸 𝗶𝗻 𝘄𝗲𝗮𝗹𝘁𝗵 𝗶𝗻 𝗼𝗻𝗹𝘆 𝟱 𝘆𝗲𝗮𝗿𝘀 𝗮𝗻𝗱 𝗺𝗼𝘃𝗲 𝘆𝗼𝘂 𝘁𝗼𝘄𝗮𝗿𝗱𝘀 𝘆𝗼𝘂𝗿 𝗻𝗲𝘅𝘁 𝗽𝗿𝗼𝗽𝗲𝗿𝘁𝘆, 𝗶𝗻𝘃𝗲𝘀𝘁𝗺𝗲𝗻𝘁 𝗼𝗿 𝗴𝗼𝗮𝗹.

At the end of the day, homeownership is not for everyone, but condos are a fantastic vehicle for investing.

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗚𝗘𝗧 𝗔 𝗣𝗜𝗘𝗖𝗘 𝗢𝗙 𝗧𝗛𝗘 𝗔𝗖𝗧𝗜𝗢𝗡 𝗢𝗡 𝗣𝗢𝗥𝗧𝗘𝗥! A captivating 3 bed, 3 bath residence with major, drool-worthy renovations including contemporary steel garage doors, lux front doors accented with a 2nd level glass railing and a custom kitchen that is the showstopper of this highly functional and sun-filled residence.

𝖧𝖨𝖦𝖧𝖫𝖨𝖦𝖧𝖳𝖲

▪️3 bedrooms (& office nook in the primary bedroom)

▪️2+1 bathrooms

▪️1,343 sq.ft + finished basement

▪️style: semi-detached

▪️property taxes: $3,328.80/2021

▪️lot size: 22.51 ft x 100.07 ft

𝗢𝗙𝗙𝗘𝗥𝗘𝗗 𝗔𝗧: $899,000

𝗩𝗜𝗥𝗧𝗨𝗔𝗟 𝗧𝗢𝗨𝗥: www.5134PorterSt.com

Photo/video: @myhomeviewer

Styling: @thestaginghouseburlington

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at living in Burlington.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

✨𝗡𝗘𝗪 𝗧𝗢 𝗠𝗔𝗥𝗞𝗘𝗧✨

𝗚𝗘𝗧 𝗔 𝗣𝗜𝗘𝗖𝗘 𝗢𝗙 𝗧𝗛𝗘 𝗔𝗖𝗧𝗜𝗢𝗡 𝗢𝗡 𝗣𝗢𝗥𝗧𝗘𝗥! A captivating 3 bed, 3 bath residence with major, drool-worthy renovations including contemporary steel garage doors, lux front doors accented with a 2nd level glass railing and a custom kitchen that is the showstopper of this highly functional and sun-filled residence.

𝖧𝖨𝖦𝖧𝖫𝖨𝖦𝖧𝖳𝖲

▪️3 bedrooms (& office nook in the primary bedroom)

▪️2+1 bathrooms

▪️1,343 sq.ft + finished basement

▪️style: semi-detached

▪️property taxes: $3,328.80/2021

▪️lot size: 22.51 ft x 100.07 ft

𝗢𝗙𝗙𝗘𝗥𝗘𝗗 𝗔𝗧: $899,000

𝗩𝗜𝗥𝗧𝗨𝗔𝗟 𝗧𝗢𝗨𝗥: www.5134PorterSt.com

Photo/video: @myhomeviewer

Styling: @thestaginghouseburlington

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at living in Burlington.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

✨𝗡𝗘𝗪 𝗧𝗢 𝗠𝗔𝗥𝗞𝗘𝗧✨

𝗔𝗟𝗟 𝗔𝗕𝗢𝗔𝗥𝗗 𝗙𝗢𝗥 𝗔𝗥𝗜𝗦𝗧𝗢! Condos can feel monotonous, but not when you’re presented with a thoughtfully designed floor plan where your needs as a buyer are exceeded with high-end finishes and a multi-functional corner unit design.

𝖧𝖨𝖦𝖧𝖫𝖨𝖦𝖧𝖳𝖲

▪️2 bedrooms (or 1 bed + ultimate work from home office )

▪️2 full bathrooms

▪️732 sq.ft + terrace

▪️condo fees: $558/month

▪️1 parking

▪️1 locker

𝗢𝗙𝗙𝗘𝗥𝗘𝗗 𝗔𝗧: $699,000

𝗩𝗜𝗥𝗧𝗨𝗔𝗟 𝗧𝗢𝗨𝗥: www.120HarrisonGardenBlvd.com

Photo/video: @myhomeviewer

Styling: @thestaginghouseburlington

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at condo living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

✨𝗡𝗘𝗪 𝗧𝗢 𝗠𝗔𝗥𝗞𝗘𝗧✨

𝗔𝗟𝗟 𝗔𝗕𝗢𝗔𝗥𝗗 𝗙𝗢𝗥 𝗔𝗥𝗜𝗦𝗧𝗢! Condos can feel monotonous, but not when you’re presented with a thoughtfully designed floor plan where your needs as a buyer are exceeded with high-end finishes and a multi-functional corner unit design.

𝖧𝖨𝖦𝖧𝖫𝖨𝖦𝖧𝖳𝖲

▪️2 bedrooms (or 1 bed + ultimate work from home office )

▪️2 full bathrooms

▪️732 sq.ft + terrace

▪️condo fees: $558/month

▪️1 parking

▪️1 locker

𝗢𝗙𝗙𝗘𝗥𝗘𝗗 𝗔𝗧: $699,000

𝗩𝗜𝗥𝗧𝗨𝗔𝗟 𝗧𝗢𝗨𝗥: www.120HarrisonGardenBlvd.com

Photo/video: @myhomeviewer

Styling: @thestaginghouseburlington

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at condo living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗧𝗛𝗘 𝗠𝗔𝗥𝗞𝗘𝗧 𝗛𝗔𝗦 𝗦𝗟𝗢𝗪𝗘𝗗 𝗗𝗢𝗪𝗡✨

The market is still in a robust territory even after overall conditions have softened.

If the market is still in seller territory, why are some properties well… not selling? Historically, the real estate market slows down in the summer months, so a well-priced home may still take several weeks to sell in today's market.

According to TRREB President Kevin Crigger, the board anticipates that this moderation is not here to stay. "We have seen market activity transition from a record pace to a robust pace over the last three months. While this could provide some relief for homebuyers in the near term, a resumption of population growth based on immigration is only months away."

𝗚𝗘𝗡𝗘𝗥𝗔𝗟 𝗦𝗧𝗥𝗔𝗧𝗘𝗚𝗬 𝗦𝗨𝗚𝗚𝗘𝗦𝗧𝗜𝗢𝗡𝗦:

𝙄𝙛 𝙮𝙤𝙪’𝙧𝙚 𝙩𝙝𝙞𝙣𝙠𝙞𝙣𝙜 𝙤𝙛 𝙗𝙪𝙮𝙞𝙣𝙜: Now is a great time to capitalize on more favourable buying conditions.

𝙄𝙛 𝙮𝙤𝙪’𝙧𝙚 𝙩𝙝𝙞𝙣𝙠𝙞𝙣𝙜 𝙤𝙛 𝙨𝙚𝙡𝙡𝙞𝙣𝙜: You may want to hold off until the fall market if you don't have to sell.

𝙄𝙛 𝙮𝙤𝙪𝙧 𝙥𝙧𝙤𝙥𝙚𝙧𝙩𝙮 𝙞𝙨 𝙘𝙪𝙧𝙧𝙚𝙣𝙩𝙡𝙮 𝙤𝙣 𝙩𝙝𝙚 𝙢𝙖𝙧𝙠𝙚𝙩: Hold tight the market will pick up!

𝗪𝗛𝗬 𝗪𝗜𝗟𝗟 𝗧𝗛𝗘 𝗠𝗔𝗥𝗞𝗘𝗧 𝗜𝗠𝗣𝗥𝗢𝗩𝗘?

▶️ Ontario is moving into the 3rd stage of the reopening plan.

▶️ The reopening of borders will create an influx of immigration.

▶️ Historically, the fall market favours sellers.

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

-

Photo: Lora Smith

I am an immigrant to this country. Calling Canada my home for the last 24+ years has been a privilege. Today is another somber reminder that the vast majority of us are immigrants to this land and Canada was founded on colonialism.

The last residential school closed in 1996.

1,505 Indigenous children have been found so far at former residential schools across Canada.

1,505 Indigenous children that were stolen from their families, stripped of their culture and subjected to inhumane treatment in the name of colonialism and religion.

Celebrating Canada is to learn about its history and to do better.

I will be observing this day by educating myself further and donating to www.IRSSS.ca

Consider allocating the money you may spend on this day to the Indian Residential School Survivors Society or the Toronto Indigenous Harm Reduction.

WWW.IRSSS.CA

WWW.TORONTOINDIGENOUSR.COM

🧡

Other homes can be visually impressive, but only the rare few have 𝙩𝙝𝙞𝙨 𝙡𝙚𝙫𝙚𝙡 of attention to design, quality of fixtures, finishes and to the things you can’t see behind the walls.

▪️2 HVAC systems, each service 2 levels of the house - this is ultimate comfort!

▪️New ductwork and electrical wiring throughout the entire house.

▪️All plumbing pipes in the house were replaced, including under slab piping in the basement.

▪️All windows and doors were replaced with Marvin windows (extruded aluminum exterior with painted wood interior - dual-sealed insulated glass with low e and argon gas).

▪️High quality insulation behind every wall.

▪️Unlike today’s new construction with a life span, Edwardian residences were built to withstand the test of time with a double brick exterior and a far higher quality of timber than its predecessor of Victoria architecture.

𝗘𝘃𝗲𝗿𝘆 𝗶𝗻𝗰𝗵 𝗼𝗳 𝘁𝗵𝗶𝘀 𝗿𝗲𝘀𝗶𝗱𝗲𝗻𝗰𝗲 𝗵𝗮𝘀 𝗯𝗲𝗲𝗻 𝗽𝗿𝗼𝗳𝗲𝘀𝘀𝗶𝗼𝗻𝗮𝗹𝗹𝘆 𝗿𝗲𝗻𝗼𝘃𝗮𝘁𝗲𝗱. 𝗘𝘅𝗽𝗲𝗿𝗶𝗲𝗻𝗰𝗲 𝘁𝗵𝗲 𝘂𝗹𝘁𝗶𝗺𝗮𝘁𝗲 𝗹𝘂𝘅𝘂𝗿𝘆 𝗶𝗻 𝗮 𝗳𝗮𝗺𝗶𝗹𝘆-𝗳𝗿𝗶𝗲𝗻𝗱𝗹𝘆 𝗮𝗻𝗱 𝘃𝗶𝗯𝗿𝗮𝗻𝘁 𝗻𝗲𝗶𝗴𝗵𝗯𝗼𝘂𝗿𝗵𝗼𝗼𝗱 𝗼𝗳 𝗗𝘂𝗳𝗳𝗲𝗿𝗶𝗻-𝗚𝗿𝗼𝘃𝗲!

-

𝗢𝗙𝗙𝗘𝗥𝗘𝗗 𝗔𝗧: $3.250MM

𝗩𝗜𝗥𝗧𝗨𝗔𝗟 𝗧𝗢𝗨𝗥: www.94DewsonSt.com

Photo/video: @myhomeviewer

Staging: @thestaginghouseburlington

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at luxury living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

Darling Dewson 😍!

We are thrilled to announce we have a feature in @storeyspublishing!

“If you’ve fantasized about snatching up a charming, multi-bed detached in one of Toronto’s most coveted neighbourhoods, now’s your chance.

Tucked into a quiet thoroughfare just off Dufferin Grove, 94 Dewson Street presents a solid argument for dreams coming true.”

Link is in our bio!

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at luxury living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

✨𝗡𝗘𝗪 𝗧𝗢 𝗠𝗔𝗥𝗞𝗘𝗧✨

𝗛𝗲𝗿𝗲 𝗮𝗿𝗲 𝙟𝙪𝙨𝙩 𝙖 𝙛𝙚𝙬 𝗵𝗶𝗴𝗵𝗹𝗶𝗴𝗵𝘁𝘀 𝘄𝗲 𝗹𝗼𝘃𝗲 𝗮𝗯𝗼𝘂𝘁 𝘁𝗵𝗶𝘀 𝗿𝗲𝘀𝗶𝗱𝗲𝗻𝗰𝗲:

1️⃣ A Show House for restored Edwardian architecture. Standing strong at 113 years old, built with formidable craftsmanship and integrity.

2️⃣ Unlike today’s new construction with a life span, Edwardian residences were built to withstand the test of time with a double brick exterior and a far higher quality of timber than its predecessor of Victoria architecture.

3️⃣ Restored details: French pocket doors, magnificent wood staircase, banister and railings, coved plaster ceilings with rose details +!

Not to mention the property has been entirely (yes, e-n-t-i-r-e-l-y… every nook and cranny) insulated and renovated. Inside and out… did you see the cedar-clad backyard and accents that highlight the exterior?! PLUS 2 HVAC systems.

Modern comforts meet superior building standards meet an architectural masterpiece with Scandinavian-inspired luxury finishes 😍

𝗩𝗜𝗥𝗧𝗨𝗔𝗟 𝗧𝗢𝗨𝗥: www.94DewsonSt.com

Photo/video: @myhomeviewer

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at luxury living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

✨𝗡𝗘𝗪 𝗧𝗢 𝗠𝗔𝗥𝗞𝗘𝗧✨

𝗙𝗿𝗲𝘀𝗵 𝗹𝗶𝗸𝗲 𝘁𝗵𝗲 𝗺𝗼𝗿𝗻𝗶𝗻𝗴 𝗗𝗲𝘄-𝘀𝗼𝗻! This Edwardian residence is unmatched in every way (𝘸𝘦’𝘳𝘦 𝘯𝘰𝘵 𝘦𝘹𝘢𝘨𝘨𝘦𝘳𝘢𝘵𝘪𝘯𝘨). High level of restoration & renovation blends century-old features & Scandinavian-inspired luxury finishes. Bulthaup kitchen & Miele appliances are complemented by the 6” white oak floors throughout. 4th bed/enviable office features a century-old brick wall & original fireplace. Top to bottom, inside & out, no stone has been left unturned.

𝖧𝖨𝖦𝖧𝖫𝖨𝖦𝖧𝖳𝖲

▪️4 bedrooms (or 3 bed + kick ass office)

▪️3 bathrooms

▪️30 x 75 FT lot

▪️2,748 total SQ.FT

▪️Front legal parking pad (2 car parking)

▪️Private backyard

𝗢𝗙𝗙𝗘𝗥𝗘𝗗 𝗔𝗧: $2.999MM

𝗩𝗜𝗥𝗧𝗨𝗔𝗟 𝗧𝗢𝗨𝗥: www.94DewsonSt.com

Photo/video: @myhomeviewer

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at luxury living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

✨𝗡𝗘𝗪 𝗧𝗢 𝗠𝗔𝗥𝗞𝗘𝗧✨

𝗙𝗿𝗲𝘀𝗵 𝗹𝗶𝗸𝗲 𝘁𝗵𝗲 𝗺𝗼𝗿𝗻𝗶𝗻𝗴 𝗗𝗲𝘄-𝘀𝗼𝗻! This Edwardian residence is unmatched in every way (𝘸𝘦’𝘳𝘦 𝘯𝘰𝘵 𝘦𝘹𝘢𝘨𝘨𝘦𝘳𝘢𝘵𝘪𝘯𝘨). High level of restoration & renovation blends century-old features & Scandinavian-inspired luxury finishes. Bulthaup kitchen & Miele appliances are complemented by the 6” white oak floors throughout. 4th bed/enviable office features a century-old brick wall & original fireplace. Top to bottom, inside & out, no stone has been left unturned.

𝖧𝖨𝖦𝖧𝖫𝖨𝖦𝖧𝖳𝖲

▪️4 bedrooms (or 3 bed + kick ass office)

▪️3 bathrooms

▪️30 x 75 FT lot

▪️2,748 total SQ.FT

▪️Front legal parking pad (2 car parking)

▪️Private backyard

𝗢𝗙𝗙𝗘𝗥𝗘𝗗 𝗔𝗧: $2.999MM

𝗩𝗜𝗥𝗧𝗨𝗔𝗟 𝗧𝗢𝗨𝗥: www.94DewsonSt.com

Photo/video: @myhomeviewer

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at luxury living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

✨𝗡𝗘𝗪 𝗧𝗢 𝗠𝗔𝗥𝗞𝗘𝗧✨

𝗙𝗿𝗲𝘀𝗵 𝗹𝗶𝗸𝗲 𝘁𝗵𝗲 𝗺𝗼𝗿𝗻𝗶𝗻𝗴 𝗗𝗲𝘄-𝘀𝗼𝗻! This Edwardian residence is unmatched in every way (𝘸𝘦’𝘳𝘦 𝘯𝘰𝘵 𝘦𝘹𝘢𝘨𝘨𝘦𝘳𝘢𝘵𝘪𝘯𝘨). High level of restoration & renovation blends century-old features & Scandinavian-inspired luxury finishes. Bulthaup kitchen & Miele appliances are complemented by the 6” white oak floors throughout. 4th bed/enviable office features a century-old brick wall & original fireplace. Top to bottom, inside & out, no stone has been left unturned.

𝖧𝖨𝖦𝖧𝖫𝖨𝖦𝖧𝖳𝖲

▪️4 bedrooms (or 3 bed + kick ass office)

▪️3 bathrooms

▪️30 x 75 FT lot

▪️2,748 total SQ.FT

▪️Front legal parking pad (2 car parking)

▪️Private backyard

𝗢𝗙𝗙𝗘𝗥𝗘𝗗 𝗔𝗧: $2.999MM

𝗩𝗜𝗥𝗧𝗨𝗔𝗟 𝗧𝗢𝗨𝗥: www.94DewsonSt.com

Photo/video: @myhomeviewer

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at luxury living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

✨𝗡𝗘𝗪 𝗧𝗢 𝗠𝗔𝗥𝗞𝗘𝗧✨

𝗡𝗼𝘁𝗵𝗶𝗻𝗴 𝗰𝗮𝗻 𝗰𝗼𝗺𝗽𝗮𝗿𝗲. Sitting perched above one of the most iconic and scenic roads in Ontario, this custom-built residence pays homage to the original home built by renowned Canadian architect Napier Simpson in 1931. An expansive 8.613 acres displays pristine and golden westerly views of the Niagara Escarpment.

The guest house offers you a comfortable home while you oversee the final completion of your dream residence in a tranquil and cottage like setting, all within less than an hour commute to the city.

𝗢𝗙𝗙𝗘𝗥𝗘𝗗 𝗔𝗧: $3.995MM

𝗩𝗜𝗥𝗧𝗨𝗔𝗟 𝗧𝗢𝗨𝗥: www.1918ForksOfTheCreditRd.com

Video: @myhomeviewer

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at rural living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

✨𝗡𝗘𝗪 𝗧𝗢 𝗠𝗔𝗥𝗞𝗘𝗧✨

1918 Forks of the Credit Rd.

𝗡𝗼𝘁𝗵𝗶𝗻𝗴 𝗰𝗮𝗻 𝗰𝗼𝗺𝗽𝗮𝗿𝗲. Sitting perched above one of the most iconic and scenic roads in Ontario, this custom-built residence pays homage to the original home built by renowned Canadian architect Napier Simpson in 1931. An expansive 8.613 acres displays pristine and golden westerly views of the Niagara Escarpment.

𝖧𝖨𝖦𝖧𝖫𝖨𝖦𝖧𝖳𝖲

𝗠𝗔𝗜𝗡 𝗥𝗘𝗦𝗜𝗗𝗘𝗡𝗖𝗘

▪️4 bedrooms & 5 bathrooms

▪️Approx. 6,120 sq.ft above grade & 1,909 sq.ft lower level

▪️Radiant heating throughout

▪️Spray foam insulation on all 3 levels

▪️All electrical has been wired

▪️All plumbing has been roughed-in

▪️4 gas (Marquis Bentley Series) fireplaces

▪️2 septic systems and 3 wells on site

▪️Property features a newly built guest house, pool house with groundskeeper residence and detached garage.

𝗚𝗨𝗘𝗦𝗧 𝗛𝗢𝗨𝗦𝗘

▪️2 bedrooms & 1 bathroom

▪️1,109 sq.ft

▪️Built in 2011

𝗢𝗙𝗙𝗘𝗥𝗘𝗗 𝗔𝗧: $3.995MM

𝗩𝗜𝗥𝗧𝗨𝗔𝗟 𝗧𝗢𝗨𝗥: www.1918ForksOfTheCreditRd.com

Photo/video: @myhomeviewer

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at rural living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗜𝗦 𝗧𝗛𝗘 𝗚𝗢𝗩𝗘𝗥𝗡𝗠𝗘𝗡𝗧 𝗦𝗧𝗘𝗣𝗣𝗜𝗡𝗚 𝗜𝗡 𝗧𝗢 𝗖𝗢𝗢𝗟 𝗧𝗛𝗘 𝗥𝗘𝗔𝗟 𝗘𝗦𝗧𝗔𝗧𝗘 𝗠𝗔𝗥𝗞𝗘𝗧?🤔

Canada’s banking regulator signalled its intent Thursday to take a small step by tightening qualification rules for uninsured mortgages, worried that low interest rates will put new home buyers too far into debt. The move will effectively reduce by about 4% the size of mortgages households will be eligible to take.

𝗪𝗵𝗮𝘁 𝗱𝗼𝗲𝘀 𝘁𝗵𝗶𝘀 𝗿𝗲𝗮𝗮𝗹𝗹𝗹𝗹𝘆 𝗺𝗲𝗮𝗻?

As of June 1, the stress test rate climbs to 5.25% from 4.79%.

𝗦𝗼𝗼𝗼... 𝘄𝗶𝗹𝗹 𝘁𝗵𝗶𝘀 𝗰𝗿𝗲𝗮𝘁𝗲 𝗮𝗻𝘆 𝗻𝗼𝘁𝗮𝗯𝗹𝗲 𝗰𝗵𝗮𝗻𝗴𝗲?

This 𝙬𝙞𝙡𝙡 𝙣𝙤𝙩 make a massive difference on your pre-approval and we don’t think it will create any significant psychological shift with buyers… not as a standalone policy.

[ Source: Financial Post ]

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

2020 was one heck of a year 😳

We are honoured to receive the Diamond Award from Sutton Group-Summit.

Our business is built around two elements: tailored solutions for each client and unique marketing in a challenging real estate market.

Safety continues to be the bedrock of how we maneuver through each day. We have implemented so many virtual elements into our business, giving our clients confidence to transact in the market safely.

We are 𝙨𝙤 𝙚𝙭𝙘𝙞𝙩𝙚𝙙 to continue to grow, so thank 𝙮𝙤𝙪. 𝗧𝗛𝗔𝗡𝗞 𝗬𝗢𝗨 for all the support! ♥️

𝗡𝗘𝗪 𝗧𝗢 𝗠𝗔𝗥𝗞𝗘𝗧✨

Luxury work/live boutique condo tucked away in the heart of King Street West on a tree-lined street with stunning southwest views overlooking the city and Victoria Memorial Square.

ESSENTIALS

▪️2 bedrooms + 1 large den

▪️2 full bathrooms

▪️1,058 sq.ft

▪️south west views

▪️2 parking (stacked) + locker

▪️Available June 01

▪️Listed for Lease: $3,400/month

Contact @wearehome for more details and to book a private tour.

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at Toronto living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗡𝗘𝗪 𝗧𝗢 𝗠𝗔𝗥𝗞𝗘𝗧✨

Part of the Trinity-Bellwoods neighbourhood, Ossington was originally constructed in the 1800’s as part of a military road. After years of going through gentrification, this little strip on the west end is now one of the city’s most desirable places to visit.

𝖤𝖲𝖲𝖤𝖭𝖳𝖨𝖠𝖫𝖲

▪️5 bedrooms, 2 bathrooms

▪️Renovated Victorian townhome

▪️16 x 92 ft lot

▪️Listed for Sale: $1,299,000

▪️Offers presented on March 09

Contact @wearehome for more details and to book a private tour.

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at Toronto living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝟮𝟬𝟮𝟭 𝗥𝗘𝗔𝗟 𝗘𝗦𝗧𝗔𝗧𝗘 𝗢𝗨𝗧𝗟𝗢𝗢𝗞✨

1️⃣Continued tight conditions in the freehold market segment. Buyers can expect strong competition for the remainder of the year.

2️⃣Condo market will recover with an uptick in appreciation.

𝗧𝗥𝗥𝗘𝗕 𝗜𝗦𝗦𝗨𝗘𝗗 𝗧𝗛𝗘 𝗙𝗢𝗟𝗟𝗢𝗪𝗜𝗡𝗚 𝗕𝗥𝗜𝗘𝗙𝗜𝗡𝗚 🏠:

✖️The pace of new condominium apartment listings will start to ebb, especially in the second half of the year. With low-rise listings remaining constrained, expect total new listings to come in at the 160,000 mark.

✖️Market conditions for low-rise homes, including detached houses, will remain very tight, with sales rising at a faster pace than listings.

✖️While mortgage deferrals were initially a concern early on in the pandemic, Mortgage Professionals Canada does not anticipate any pronounced uptick in mortgage delinquencies that would create systemic concerns as we move through 2021. Most property owners who took advantage of mortgage deferrals did so out of an abundance of caution rather than financial necessity and therefore have resumed their regular payments.

𝘚𝘰𝘶𝘳𝘤𝘦: TRREB Forecasts Strong Demand for Real Estate in 2021

𝘗𝘩𝘰𝘵𝘰: www.Danthree.com

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗖𝗠𝗛𝗖: 𝗛𝗢𝗠𝗘 𝗣𝗥𝗜𝗖𝗘𝗦 𝗖𝗢𝗨𝗟𝗗 𝗙𝗔𝗟𝗟 𝟰𝟳.𝟵% 𝗜𝗡 𝗪𝗢𝗥𝗦𝗧 𝗖𝗔𝗦𝗘 𝗦𝗖𝗘𝗡𝗔𝗥𝗜𝗢 🤦🏼♀️

It’s not beneficial to issue speculation, the only thing this spreads is confusion and misinformation.

Let’s unpack this headline… you’ll feel 𝙖 𝙡𝙤𝙩 𝙡𝙞𝙜𝙝𝙩𝙚𝙧!

CMHC has been wrong before ❌

The CEO made headlines in May 2020 when he forecast a decline in average house prices of 9-18% in the coming 12 months, but that hasn’t panned out so far with record price appreciation in many markets.

𝗧𝗛𝗘 𝗚𝗧𝗔 𝗣𝗘𝗥𝗙𝗢𝗥𝗠𝗘𝗗 𝗦𝗜𝗚𝗡𝗜𝗙𝗜𝗖𝗔𝗡𝗧𝗟𝗬 𝗔𝗕𝗢𝗩𝗘 𝗘𝗫𝗣𝗘𝗖𝗧𝗔𝗧𝗜𝗢𝗡𝗦 𝗜𝗡 𝟮𝟬𝟮𝟬

✖️Average price increased - 11.2%

✖️Real GDP growth - up 40.6% in Q3

✖️Inflation growth increased - 1%

✖️Bank of Canada Overnight Rate - steady at 0.25%

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

Sources: BNN Bloomberg

via Rue Magazine, photography by Jacqueline Marque

𝗛𝗢𝗪 𝗧𝗢 𝗟𝗘𝗩𝗘𝗥𝗔𝗚𝗘 𝙊𝙏𝙃𝙀𝙍𝙎 𝗠𝗢𝗡𝗘𝗬 𝗙𝗢𝗥 𝙔𝙊𝙐𝙍 𝗕𝗘𝗡𝗘𝗙𝗜𝗧✨

When you own real estate, you not only benefit from the shelter it provides, but there is a multitude of additional financial benefits you 𝘮𝘢𝘺 𝘯𝘰𝘵 𝘩𝘢𝘷𝘦 𝘤𝘰𝘯𝘴𝘪𝘥𝘦𝘳𝘦𝘥.

✖️Ability to refinance your home's equity

✖️Use that equity to purchase an income-producing property and diversify your income streams - think passive income!

✖️Utilizing corporate business structures for tax relief benefits

When you purchase real estate, you are effectively leveraging the bank's money in your favour.

𝗛𝗼𝘄?

Take for example, a $650,000 condo purchase.

Your minimum downpayment is $34,000.

✨That is 𝟲.𝟭𝟱% of the purchase price and the bank provides the 𝗼𝘁𝗵𝗲𝗿 𝟵𝟯.𝟴𝟱%✨

After 5 years, the average appreciation of a condo in Toronto increased by 12.5% year-over-year from 2015 to 2020. But let’s err on the side of caution and estimate an average appreciation of 6.25% per year, and you end up with a 𝗰𝗼𝗻𝘀𝗲𝗿𝘃𝗮𝘁𝗶𝘃𝗲 𝗻𝗲𝘁 𝗽𝗿𝗼𝗳𝗶𝘁 𝗼𝗳 𝗮𝗯𝗼𝘂𝘁 $𝟯𝟮𝟲,𝟬𝟬𝟬!

$34,000 of your own money can turn into $326,000 of profit in 5 years.

𝗧𝗵𝗮𝘁 𝗶𝘀 𝟵.𝟱𝟵𝗫 𝗼𝗻 𝘆𝗼𝘂𝗿 𝗶𝗻𝗶𝘁𝗶𝗮𝗹 𝗶𝗻𝘃𝗲𝘀𝘁𝗺𝗲𝗻𝘁, 𝗮𝗻 𝟴𝟱𝟵% 𝗶𝗻𝗰𝗿𝗲𝗮𝘀𝗲.

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

Photo: CB2

𝗧𝗛𝗜𝗦 𝗢𝗡𝗘 𝗜𝗦 𝗙𝗢𝗥 𝗜𝗡𝗩𝗘𝗦𝗧𝗢𝗥𝗦! ✨

When purchasing an income property, you will want to understand your financial goals, net operating income and numbers to form a solid investment strategy.

𝙏𝙔𝙋𝙀𝙎 𝙊𝙁 𝙁𝙄𝙉𝘼𝙉𝘾𝙄𝘼𝙇 𝙂𝙊𝘼𝙇𝙎

1️⃣ Positive monthly cash flow

2️⃣ Appreciation focused

3️⃣ Understanding that positive cash flow may not be possible but strike a balance with strong appreciation

Even properties that are not net positive each month can serve an investor really well in the short-medium term. The average appreciation of a condo in the city increased by 12.5% year over year from 2015 to early 2020.

This is where your 𝗡𝗘𝗧 𝗢𝗣𝗘𝗥𝗔𝗧𝗜𝗡𝗚 𝗜𝗡𝗖𝗢𝗠𝗘 (𝗡𝗢𝗜) is beneficial.

𝘿𝙀𝙁𝙄𝙉𝙄𝙏𝙄𝙊𝙉

𝗡𝗢𝗜: “one of several indicators used to determine whether a subject property will make a good investment. By measuring the ongoing operating costs of a property” (FortuneBuilders.com)

𝙃𝙊𝙒 𝘿𝙊 𝙔𝙊𝙐 𝘾𝘼𝙇𝘾𝙐𝙇𝘼𝙏𝙀 𝙉𝙊𝙄?

Income Generated From Property – Operating Expenses = NOI

𝙒𝙃𝘼𝙏 𝙄𝙎 𝙄𝙉𝘾𝙇𝙐𝘿𝙀𝘿 𝙄𝙉 𝙊𝙋𝙀𝙍𝘼𝙏𝙄𝙉𝙂 𝙀𝙓𝙋𝙀𝙉𝙎𝙀𝙎?

✖️Property Management Fee

✖️General Maintenance

✖️Legal Fees

✖️Utilities Not Paid By Tenants

✖️Property Taxes

✖️Insurance Costs

𝙄𝙎 𝘼 𝙈𝙊𝙍𝙏𝙂𝘼𝙂𝙀 𝙄𝙉𝘾𝙇𝙐𝘿𝙀𝘿 𝙄𝙉 𝙉𝙊𝙄?

Mortgage payments are not considered an operating expense. Again, as its name suggests, net operating income accounts for an asset’s total income and subtracts vacancies and operating expenses.

📣

When you break down your financial output each month, look at a worst-case scenario to allow room for flexibility in your budget and market fluctuations.

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗛𝗢𝗪 𝗪𝗜𝗟𝗟 𝗧𝗛𝗘 𝗡𝗘𝗪 𝗖𝗢𝗩-𝟭𝟵 𝗥𝗘𝗦𝗧𝗥𝗜𝗖𝗧𝗜𝗢𝗡𝗦 𝗔𝗙𝗙𝗘𝗖𝗧 𝗥𝗘𝗔𝗟 𝗘𝗦𝗧𝗔𝗧𝗘?✨

Real Estate is deemed an 𝗲𝘀𝘀𝗲𝗻𝘁𝗶𝗮𝗹 𝘀𝗲𝗿𝘃𝗶𝗰𝗲 and as such, your essential plans to trade in Real Estate will not be affected by the new restrictions.

-

It’s important to preface this post that we, at We Are Home, take 𝘢𝘭𝘭 𝘱𝘳𝘦𝘤𝘢𝘶𝘵𝘪𝘰𝘯𝘴 to ensure our clients are safe when physically touring properties and also offer a detailed Virtual Home Buying and Selling Concierge Service.

-

𝗕𝗘𝗟𝗢𝗪 𝗔𝗥𝗘 𝗧𝗛𝗘 𝗡𝗘𝗪 𝗥𝗘𝗦𝗧𝗥𝗜𝗖𝗧𝗜𝗢𝗡𝗦 𝗘𝗙𝗙𝗘𝗖𝗧𝗜𝗩𝗘 𝟭𝟮:𝟬𝟭 𝗔.𝗠. 𝗧𝗛𝗨𝗥𝗦𝗗𝗔𝗬✨

✖️Ontario will be placed under a stay-at-home order, which will require everyone to remain at home with exceptions for essential purposes, like going to the grocery store or pharmacy, accessing health care services, for exercise or for 𝗲𝘀𝘀𝗲𝗻𝘁𝗶𝗮𝗹 𝘄𝗼𝗿𝗸.

✖️No return to in-class learning until Feb. 11 at the earliest for the following public health units: Windsor-Essex, Peel Region, Toronto, York Region and Hamilton.

✖️All businesses must ensure any employee who can work from home do so.

✖️Gatherings are restricted to five people, consistent with the first-wave lockdown rules.

✖️Masks remain mandatory indoors at open businesses or organizations. Masks are also now being recommended outdoors where physical distancing of two metres or more is not possible.

✖️There will be reduced hours for non-grocery stores and pharmacies. All non-essential retail will be forced to close at 8 p.m. and open no later at 7 a.m. These limits don't apply to stores that primarily sell food, gas stations, pharmacies, convenience stores or restaurants providing take-out or delivery.

✖️No restrictions on the purchase of non-essential items.

✖️Short-term rentals for recreational purposes are effectively closed as of January 12th, 2021. If a booking was made prior to January 12th it is permitted to go forward.

✖️Renovations started before January 12th will be permitted to continue but those that have not started are not permitted to start. The government has not indicated when the new measures will be lifted.

-

Photo: eklundstockholmnewyork

𝗡𝗘𝗪 𝗧𝗢 𝗠𝗔𝗥𝗞𝗘𝗧✨

A historic Center-Hall Victorian built in 1869

𝖧𝖨𝖦𝖧𝖫𝖨𝖦𝖧𝖳𝖲

▪️3 bed, 2 bath

▪️Diligently renovated

▪️Rare 42 ft x 125 ft lot

▪️11’ ceilings, original crown and baseboards

▪️Moss Park I Sherbourne St and Gerrard St E

▪️Lane drive with 2 parking spaces

▪️Listed for Sale: $2.198MM

Contact @_wearehome for more details and to book a private tour.

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at Toronto living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗠𝗔𝗥𝗞𝗘𝗧 𝗣𝗥𝗘𝗗𝗜𝗖𝗧𝗜𝗢𝗡𝗦 - 𝗖𝗢𝗡𝗗𝗢𝗦 ✨

2020 moved into a 𝘀𝘁𝗿𝗼𝗻𝗴 𝗯𝘂𝘆𝗲𝗿𝘀 𝗺𝗮𝗿𝗸𝗲𝘁 in the GTA and presented great opportunities for first-time homebuyers and investors.

If you are on the fence and waiting to 𝗯𝘂𝘆, we recommend to 𝙚𝙣𝙩𝙚𝙧 𝙩𝙝𝙚 𝙢𝙖𝙧𝙠𝙚𝙩 sooner rather than later. Why?

1️⃣ 𝗜𝗻𝘃𝗲𝗻𝘁𝗼𝗿𝘆 𝗶𝘀 𝗱𝗲𝗰𝗿𝗲𝗮𝘀𝗶𝗻𝗴, 𝗮𝗻𝗱 𝘀𝗮𝗹𝗲𝘀 𝗮𝗿𝗲 𝘂𝗽.

For the first time in months, December had more sales than new listings. New listings dropped by 75% and sales were up by 12%. That means that months of inventory dropped to 2.0 last month in the 416.

2️⃣ 𝗠𝗼𝗿𝘁𝗴𝗮𝗴𝗲 𝗿𝗮𝘁𝗲𝘀 𝗮𝗿𝗲 𝗹𝗼𝘄 (𝙫𝙚𝙧𝙮 𝙡𝙤𝙬).

The Bank of Canada's overnight lending rate is steady at 0.25%. The Bank has referred to this as the “effective lower boundary” of the overnight rate and that it will likely not increase it until inflation hits its 2% target.

If you are interested in 𝘀𝗲𝗹𝗹𝗶𝗻𝗴 your condo, 𝙝𝙤𝙡𝙙 𝙤𝙛𝙛 𝙛𝙤𝙧 𝙖 𝙗𝙞𝙩 𝙡𝙤𝙣𝙜𝙚𝙧 as more units are expected to be absorbed by an increase in buyers.

𝗣𝗥𝗘𝗗𝗜𝗖𝗧𝗜𝗢𝗡𝗦 ✨

✖️The condo market will begin to strengthen with widespread inoculation of the COV-19 vaccine, re-opening of borders, influx of immigration, foreign workers and international students that will help to stabilize the condo resale and rental markets.

✖️Bond yields will likely rise and modestly increase fixed mortgage rates.

✖️No new introduction of mortgage and real estate intervention and regulations to artificially adjust the markets.

✖️905 condo price appreciation will likely outperform 416 markets.

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗬𝗢𝗨’𝗟𝗟 𝙇𝙊𝙑𝙀 𝗧𝗛𝗘 𝗗𝗘𝗧𝗔𝗜𝗟𝗦 𝗜𝗡 𝗢𝗨𝗥 𝗛𝗔𝗥𝗗 𝗟𝗢𝗙𝗧 𝗟𝗜𝗦𝗧𝗜𝗡𝗚 #noblecourtlofts ✨

𝖧𝖨𝖦𝖧𝖫𝖨𝖦𝖧𝖳𝖲

▪️1 bed + gallery style office / 1 bath

▪️Built in 1910

▪️900-999 sq.ft

▪️Common and street parking available

▪️South Parkdale

▪️Listed for Lease: $2,999/month

Photography: @myhomeviewer

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at loft living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗘𝗠𝗘𝗥𝗚𝗜𝗡𝗚 𝗧𝗥𝗘𝗡𝗗𝗦 𝗜𝗡 𝗥𝗘𝗔𝗟 𝗘𝗦𝗧𝗔𝗧𝗘 ✨

In the face of the last 7 months, the market has experienced unprecedented growth in many markets proving that Canadian real estate market is overall, 𝘱𝘳𝘦𝘵𝘵𝘺 𝘥𝘢𝘮𝘯 𝘳𝘦𝘴𝘪𝘭𝘪𝘦𝘯𝘵. A crisis can sometime be a great accelerator to plans, so what trend could we expect in 2021?

𝗥𝗘𝗦𝗜𝗗𝗘𝗡𝗧𝗜𝗔𝗟

𝖳𝖧𝖤 𝟣𝟪-𝖧𝖮𝖴𝖱 𝖢𝖨𝖳𝖸 𝖳𝖱𝖤𝖭𝖣🏡

Suburban and rural areas become more desirable as an alternative away from major cities as more people work from home. According to Investopedia, 18-hour cities “describe a mid-size city with attractive amenities, higher-than-average population growth, and a lower cost of living and cost of doing business than the biggest urban areas.”

𝗖𝗢𝗠𝗠𝗘𝗥𝗖𝗜𝗔𝗟

𝖱𝖤𝖳𝖠𝖨𝖫 𝖳𝖱𝖮𝖴𝖡𝖫𝖤𝖲 & 𝖶𝖠𝖱𝖤𝖧𝖮𝖴𝖲𝖨𝖭𝖦 𝖦𝖠𝖨𝖭𝖲🧱

According to the report, warehousing and fulfillment centres were identified as the “number one best bet.” With the retail industry being impacted by lockdown measures brought out by the pandemic, COV-19 accelerated the already growing move to eCommerce.

𝖮𝖥𝖥𝖨𝖢𝖤 𝖲𝖯𝖠𝖢𝖤💼

According to PwC Canada’s Workforce of the future survey published in September 2020, 34% of employees said they prefer to work mostly or entirely remotely, 37% want to be in the office most or all of the time, with the remaining 29% looking for an even split between the two options.

“We’re hearing different points of views on office space. Companies that have the digital capabilities to have a remote workforce are now reevaluating their real estate portfolio needs.”

“The coming year will be all about embracing opportunities to be resilient in the face of uncertainty while shifting strategies in anticipation of market headwinds,” says Frank Magliocco, National Real Estate Leader, PwC Canada.

[Info from PwC Canada and the Urban Land Institute]

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

Photo/design: CB2

𝗡𝗘𝗪 𝗧𝗢 𝗠𝗔𝗥𝗞𝗘𝗧✨

𝖭𝖮𝖡𝖫𝖤 𝖢𝖮𝖴𝖱𝖳 𝖫𝖮𝖥𝖳𝖲

An authentic piece of noble Toronto history. Originally built in 1910, this corner unit is lined with large picture windows, encased in heavy timber posts, 10 ft sandblasted wood ceiling and exposed brick. Lux and loft features compliment this almost 1,000 sq.ft space with heated bathroom floors, authentic weighted barn door and trauma room cabinet storage system, kitchen granite countertops, master bedroom closet system and pivoting floor to ceiling mirror.

𝖧𝖨𝖦𝖧𝖫𝖨𝖦𝖧𝖳𝖲

▪️1 bed + gallery style office / 1 bath

▪️900-999 sq.ft

▪️Common and street parking available

▪️South Parkdale

▪️Listed for Sale: $3,150/month

Photography: @myhomeviewer

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at loft living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗛𝗼𝘄 𝗹𝗼𝗻𝗴 𝘀𝗵𝗼𝘂𝗹𝗱 𝘆𝗼𝘂 𝘄𝗮𝗶𝘁 𝗯𝗲𝗳𝗼𝗿𝗲 𝘆𝗼𝘂 𝘀𝗲𝗹𝗹?

Even as an end-user of the property, you are 𝘴𝘵𝘪𝘭𝘭 an investor. As such, you should be aware of your short to long term market gains. Not all sales can be made at the right time, and there are 𝙨𝙤 𝙢𝙖𝙣𝙮 𝙛𝙖𝙘𝙩𝙤𝙧𝙨 that contribute to you liquidating your asset. With that said, there are a few rules of thumb economists suggest you follow:

✨𝗛𝗢𝗟𝗗 𝗧𝗛𝗘 𝗣𝗥𝗢𝗣𝗘𝗥𝗧𝗬 𝗙𝗢𝗥 𝟱-𝟳 𝗬𝗘𝗔𝗥𝗦✨.

5 years is statistically the average mortgage term, and 7 years if historically a healthy span spent on the market to achieve the following:

✖️Long enough to go through the ups and downs of the economic cycle.

✖️You would have fully amortized your acquisition and disposal costs (i.e. closing costs).

𝗜𝘀 𝗶𝘁 𝘀𝗺𝗮𝗿𝘁 𝘁𝗼 𝘀𝗲𝗹𝗹 𝘆𝗼𝘂𝗿 𝗵𝗼𝗺𝗲 𝗯𝗲𝗳𝗼𝗿𝗲 𝘁𝗵𝗲𝘀𝗲 𝟮 𝗳𝗮𝗰𝘁𝗼𝗿𝘀 𝗼𝗰𝗰𝘂𝗿𝗲?

𝘏𝘦𝘤𝘬, 𝘺𝘦𝘴!! The market can often be extremely favourable to realize substantial gains in a short amount of time, but we always suggest to err on the side of caution and still have a long-term plan!

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗖𝗢𝗡𝗗𝗢 𝗥𝗘𝗡𝗧𝗔𝗟 𝗠𝗔𝗥𝗞𝗘𝗧 𝗮𝗻𝗱 𝘁𝗵𝗲 𝘁𝗼𝗽 𝟯 (𝙢𝙖𝙟𝙤𝙧) 𝘀𝗵𝗶𝗳𝘁𝘀 📬

1️⃣ Listing inventory is up… 𝘸𝘢𝘺 𝘶𝘱

2️⃣ Continued year-over-year decline in rental prices

3️⃣ Diminished tourism sector, restricted international workers and students, paused immigration and WFH.

The rental market is complex and can leave a landlord in a difficult position. If rental prices have adjusted up to 17%, we may see more stressed landlords list their units continuing to increase condo inventory.

“From Manhattan to Toronto, and San Francisco to Vancouver, rental markets are transacting at a discount, which is what many of those priced out of centrally located communities need to find digs in choice neighbourhoods.” [Murtaza Haider Financial Post]

𝗢𝘁𝗵𝗲𝗿 𝘁𝗿𝗲𝗻𝗱𝗶𝗻𝗴 𝘀𝘁𝗮𝘁𝘀:

✖️ The average rent of a 3 bed condo declined 8.7%, but we noted an increase of 1.1% for a similar-sized townhouse. Why? Housing styles matter more and renters have more inventory to select from.

✖️ Larger-sized ground-oriented dwellings with more sq.ft and backyard space are seeing an increase in demand across the board, particularly in Toronto’s urban core.

✖️ A decline in tourism and change to short-term rental regulations contributed to units being converted to long-term rentals and additional re-sale units.

✖️ Surge in new construction bringing new rental units to the vacancy mix.

𝗪𝗵𝗮𝘁 𝗰𝗮𝗻 𝘄𝗲 𝗲𝘅𝗽𝗲𝗰𝘁 𝘁𝗼 𝘀𝗲𝗲 𝗶𝗻 𝘁𝗵𝗲 𝗹𝗮𝘀𝘁 𝗾𝘂𝗮𝗿𝘁𝗲𝗿 𝗼𝗳 𝟮𝟬𝟮𝟬?

✖️ 𝗦𝗵𝗼𝗿𝘁-𝗺𝗲𝗱𝗶𝘂𝗺 𝘁𝗲𝗿𝗺: We are dealing with too many factors that are creating a very mixed picture of the rental housing market. As long as COV-19 is preventing tourism, immigration and travel restrictions we won’t be able to forecast many trends.

✖️ 𝗟𝗼𝗻𝗴-𝘁𝗲𝗿𝗺: WFH, short-term rental regulations will remain in place changing the landscape of the rental market.

[source: Murtaza Haider Financial Post and TRREB]

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗡𝗘𝗪 𝗧𝗢 𝗠𝗔𝗥𝗞𝗘𝗧✨

KING CHARLOTTE CONDOS

All hail the king! It’s easy to worship concrete 9-ft ceilings, wall-to-wall windows, a hard-to-find 172-sq.ft balcony with a bbq gas hook-up and unobstructed south views of the city. This light filled and open concept loft features natural toned engineered hardwood floors, a sleek custom designed European inspired kitchen, gas cooktop, glass tile backsplash, stone counters and finished with industrial styling.

𝖧𝖨𝖦𝖧𝖫𝖨𝖦𝖧𝖳𝖲

▪️1 bed / 1 bath

▪️516 sq.ft

▪️Infinity rooftop pool, exercise room, concierge ++

▪️King St and Spadina Ave

▪️Listed for Lease: $2,150/month partially furnished

▪️Listed for Lease: $2,400/month fully furnished

Photography: @apartinc

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at loft living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗡𝗘𝗪 𝗧𝗢 𝗠𝗔𝗥𝗞𝗘𝗧✨

𝖢𝖠𝖭𝖣𝖸 𝖥𝖠𝖢𝖳𝖮𝖱𝖸 𝖫𝖮𝖥𝖳𝖲

Sink your teeth into this fully renovated historic loft, originally built in 1930 and home of Ce De Candy Company. This sweet Rocket showcases 12.5 ft ceilings, original sandblasted Douglas Fir beams and ceiling, refinished solid wood flooring, ample in-unit storage (don’t miss the crawl space under the bedroom), custom closet shelving, track-lighting throughout and an iconic original brick wall that spans the length of the unit.

𝖧𝖨𝖦𝖧𝖫𝖨𝖦𝖧𝖳𝖲

▪️1 bed / 1 bath

▪️861 sq.ft

▪️Including parking, heat and water

▪️Queen St W steps to Trinity-Bellwoods Park

▪️Listed for Lease: $3,399/month

Photography: @myhomeviewer

-

Booking a private tour with us will introduce you to the next step in your life. We will show you the neighbourhood, essentials to your lifestyle and a curated look at loft living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝖬𝖨𝖢𝖱𝖮 𝖢𝖮𝖭𝖣𝖮𝖲 𝖲𝖤𝖤 𝖳𝖧𝖤 𝙇𝘼𝙍𝙂𝙀𝙎𝙏 𝙋𝙍𝙄𝘾𝙀 𝘿𝙍𝙊𝙋

In September, year-over-year condo prices have softened… with a significant drop in units at 500 sq.ft and under:

▪️Condos under 500 sq.ft - prices 𝗱𝗼𝘄𝗻 20%.

▪️Condos between 500-699 sq.ft - prices 𝘂𝗽 13%.

▪️Condos between 700-999 sq.ft - prices 𝘂𝗽 12%.

▪️Condos between 1,000-plus - prices 𝘂𝗽 5%.

“It’s become clear that COVID-19 has caused two shifts in demand: A desire for more space and more value-oriented homes outside the core, both of which negatively impact the market for small condos,” said Shaun Hildebrand, president of Urbanation.

Most of the current market appreciation is driven by ground-oriented market segments and not the condo market. At the end of September, we realized a 215% increase in active listings, and on average rent has come down about 11%. The downtown core market is significantly affected by a stop to immigration, changes to Air B and B rules and new condo supply.

𝖠𝖱𝖤 𝖸𝖮𝖴 𝖳𝖧𝖨𝖭𝖪𝖨𝖭𝖦 𝖮𝖥 𝖲𝖤𝖫𝖫𝖨𝖭𝖦 𝖠 𝖬𝖨𝖢𝖱𝖮 𝖢𝖮𝖭𝖣𝖮?

𝗡𝗼𝘄 𝗶𝘀 𝗡𝗢𝗧 𝗮 𝗴𝗼𝗼𝗱 𝘁𝗶𝗺𝗲 𝘁𝗼 𝘀𝗲𝗹𝗹. We recommend to hold onto that unit if possible and be realistic if you are seeking to rent it out. Offer incentives in a competitive market such as a rent-free period or commission incentives for brokers. Utilize good (free) rental websites like Padmapper.com and Zumper.com.

𝖠𝖱𝖤 𝖸𝖮𝖴 𝖳𝖧𝖨𝖭𝖪𝖨𝖭𝖦 𝖮𝖥 𝖯𝖴𝖱𝖢𝖧𝖠𝖲𝖨𝖭𝖦 𝖠 𝖢𝖮𝖭𝖣𝖮?

𝗧𝗮𝗸𝗲 𝗮𝗱𝘃𝗮𝗻𝘁𝗮𝗴𝗲 𝗼𝗳 𝗮 𝗯𝘂𝘆𝗲𝗿𝘀 𝗺𝗮𝗿𝗸𝗲𝘁. A surge in inventory has created a buyers market with the most significant opportunity to purchase below market value in the downtown core. Paired with very low-interest rates, buyers (especially first-time home buyers) can negotiate much more favourable terms and softer sale prices.

(source: Urbanation & National Post)

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

Listing by Sage Real Estate Limited

𝗡𝗘𝗪 𝗧𝗢 𝗠𝗔𝗥𝗞𝗘𝗧✨

𝖥𝖾𝖺𝗍𝗎𝗋𝖾𝖽 𝖵𝗂𝖼𝗍𝗈𝗋𝗂𝖺𝗇 𝗌𝖾𝗆𝗂-𝖽𝖾𝗍𝖺𝖼𝗁𝖾𝖽 𝗐𝗂𝗍𝗁 𝗂𝗇𝖼𝗈𝗆𝖾 𝗉𝗈𝗍𝖾𝗇𝗍𝗂𝖺𝗅

Two luxury suites designed by Bedfordbrooks. Featuring 10’ ceilings on the main floor and 12’ cathedral ceilings in the master bedroom.

𝖧𝖨𝖦𝖧𝖫𝖨𝖦𝖧𝖳𝖲

▪️Little Portugal

▪️4 bedrooms

▪️4+1 bathrooms

▪️Live-in & rent approximately $4300/month per suite

▪️Listed for Sale: $2.388MM

Photography: RealVision

-

Booking a private tour with us will introduce you to the next step in your life; we will show you the neighbourhood, essentials to your lifestyle and a curated look at Toronto living.

✉️: Hello@WeAreHome.ca

📞: 647-838-5452

𝗧𝗼𝗿𝗼𝗻𝘁𝗼 𝗵𝗼𝗺𝗲 𝗽𝗿𝗶𝗰𝗲𝘀 𝗶𝗻𝗰𝗿𝗲𝗮𝘀𝗲𝗱 𝗯𝘆 𝟰𝟮.𝟯% 𝘆𝗲𝗮𝗿-𝗼𝘃𝗲𝗿-𝘆𝗲𝗮𝗿 𝗶𝗻 𝗦𝗲𝗽𝘁𝗲𝗺𝗯𝗲𝗿.

𝙒𝙝𝙖𝙩 𝙙𝙧𝙤𝙫𝙚 𝙩𝙝𝙞𝙨 𝙚𝙡𝙚𝙫𝙖𝙩𝙚𝙙 𝙞𝙣𝙘𝙧𝙚𝙖𝙨𝙚? 𝖫𝖺𝗋𝗀𝖾𝗅𝗒 𝖼𝖺𝗋𝗋𝗂𝖾𝖽 𝖻𝗒 𝗍𝗁𝖾 𝖿𝗋𝖾𝖾𝗁𝗈𝗅𝖽 𝗆𝖺𝗋𝗄𝖾𝗍.

✖️Low inventory

✖️Improving economic conditions

✖️Low borrowing costs

✖️Pent up demand from a stalled spring market

𝗖𝗔𝗨𝗧𝗜𝗢𝗡⚠️: A cool down is 𝘭𝘪𝘬𝘦𝘭𝘺 set to start taking effect in the coming weeks and months as pent up demand is satisfied. However, list inventory will need to increase as well, and this will largely depend on the trajectory of COV-19 as we move through the second wave.

Source: malgodt.dk

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

💌: Hello@WeAreHome.ca

📞: 647-838-5452

𝗥𝗘𝗖𝗔𝗣 𝗢𝗙 𝗧𝗛𝗘 𝗧𝗛𝗥𝗢𝗡𝗘 𝗦𝗣𝗘𝗘𝗖𝗛 🇨🇦 - 𝗵𝗼𝘂𝘀𝗶𝗻𝗴 𝘄𝗮𝘀 𝗮 𝘽𝙄𝙂 𝗽𝗮𝗿𝘁.

Home ownership remains a government priority and a 𝘥𝘳𝘪𝘷𝘪𝘯𝘨 𝘧𝘰𝘳𝘤𝘦 𝘣𝘦𝘩𝘪𝘯𝘥 𝘊𝘢𝘯𝘢𝘥𝘪𝘢𝘯 𝘎𝘋𝘗, as they announced their intention to continue supporting first-time home buyers by moving forward with enhancements to the First-Time Home Buyer Incentive, so families can afford to buy their first home.

The government also confirmed their intention to make Canadian housing stock more energy efficient while creating jobs for Canadians to retrofit homes and buildings.

The importance of home during the pandemic was stressed, as were efforts to help those without adequate housing who have been the most severely impacted. CREA, TRREB and the real estate industry have supported calls for solutions to create affordable housing and are pleased to see investment through the Rapid Housing Initiative announced earlier this week.

𝗢𝗧𝗛𝗘𝗥 𝗛𝗜𝗚𝗛𝗟𝗜𝗚𝗛𝗧𝗦

✖️𝗜𝗻𝗳𝗿𝗮𝘀𝘁𝗿𝘂𝗰𝘁𝘂𝗿𝗲 𝗶𝗻𝘃𝗲𝘀𝘁𝗺𝗲𝗻𝘁𝘀: Specifically public transit, energy efficiency building retrofits, affordable housing construction, and universal broadband access.

✖️𝗝𝗼𝗯 𝗰𝗿𝗲𝗮𝘁𝗶𝗼𝗻: A campaign to create over one million jobs.

✖️𝗣𝗹𝗲𝗱𝗴𝗲 𝘁𝗼 𝗮𝗱𝗱𝗿𝗲𝘀𝘀 𝘀𝘆𝘀𝘁𝗲𝗺𝗶𝗰 𝗿𝗮𝗰𝗶𝘀𝗶𝗺: By investing in economic empowerment to racialized communities.

✖️𝗔𝗱𝗱𝗶𝘁𝗶𝗼𝗻𝗮𝗹 𝘁𝗮𝘅𝗮𝘁𝗶𝗼𝗻 𝗼𝗳 𝘄𝗲𝗮𝗹𝘁𝗵𝘆 𝗶𝗻𝗱𝗶𝘃𝗶𝗱𝘂𝗮𝗹𝘀: Specifically targeting stock options for taxation.

[TRREB NEWS]

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

💌: Hello@WeAreHome.ca

📞: 647-838-5452

𝗡𝗲𝘄 𝗵𝗼𝗺𝗲 𝗰𝗼𝗻𝘀𝘁𝗿𝘂𝗰𝘁𝗶𝗼𝗻 - 𝙬𝙝𝙮 𝙖𝙧𝙚 𝙥𝙧𝙞𝙘𝙚𝙨 𝙤𝙣 𝙖 𝙦𝙪𝙞𝙘𝙠 𝙧𝙞𝙨𝙚?

𝗟𝘂𝗺𝗯𝗲𝗿 𝗰𝗼𝘀𝘁𝘀 𝗮𝗿𝗲 ⬆️!

Canadian new home prices recorded their 𝘴𝘩𝘢𝘳𝘱𝘦𝘴𝘵 1-month gain in 3 years with higher demand and rising costs for building materials.

All while construction on new homes surged to the highest level since 2007.

𝗪𝗵𝘆 𝗮𝗿𝗲 𝗹𝘂𝗺𝗯𝗲𝗿 𝗽𝗿𝗶𝗰𝗲𝘀 𝗶𝗻𝗰𝗿𝗲𝗮𝘀𝗶𝗻𝗴?

𝙍𝙞𝙨𝙚 𝙞𝙣 𝙙𝙚𝙢𝙖𝙣𝙙. Homebuilders say increases this year to date will translate into $8,000 to $10,000 more to build a typical single-family house in Canada.

✖️Increase in interest in renovation by people who are working from home during COV-19.

✖️Strong housing market in Canada and the U.S.

✖️Low interest rates.

✖️Supply has been affected by several mills in British Columbia which closed over the past year due to a shortage of wood fibre after a mountain pine beetle infestation and recent wildfires.

✖️Many North American mills have closed temporarily during COV-19.

[BNN Bloomberg, CBC]

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

💌: Hello@WeAreHome.ca

📞: 647-838-5452

“A great building must begin with the immeasurable, must go through measurable means when it is being designed, and in the end must be unmeasured.”

-𝘓𝘰𝘶𝘪𝘴 𝘒𝘢𝘩𝘯

New York last fall🗽

𝗛𝗼𝘂𝘀𝗶𝗻𝗴 𝗶𝘀 𝙨𝙩𝙞𝙡𝙡 𝙩𝙝𝙚 𝙗𝙚𝙨𝙩 𝗶𝗻𝘃𝗲𝘀𝘁𝗺𝗲𝗻𝘁 𝗳𝗼𝗿 𝗺𝗼𝘀𝘁 𝗖𝗮𝗻𝗮𝗱𝗶𝗮𝗻𝘀 📊.

According to the CMHC, average Canadian house values have 𝘪𝘯𝘤𝘳𝘦𝘢𝘴𝘦𝘥 by over 5% annually over 25-year periods going back to the Second World War. That includes the 2008 global financial meltdown when predictions for a housing market collapse never materialized.

BNN Bloomberg has noted that many homeowners have already benefited from the pre-pandemic housing boom. Based on healthy, long-term appreciation, 𝗮𝗻𝘆 𝗱𝗲𝗰𝗹𝗶𝗻𝗲 𝗼𝘃𝗲𝗿 𝘁𝗵𝗲 𝗻𝗲𝘅𝘁 𝗻𝘂𝗺𝗯𝗲𝗿 𝗼𝗳 𝘆𝗲𝗮𝗿𝘀 𝗰𝗮𝗻 𝗯𝗲 𝗮𝗯𝘀𝗼𝗿𝗲𝗱.

“For potential homeowners, the next 3 years could finally open an affordable window to the residential real estate market. One of the biggest pre-pandemic risks in the housing market was the threat of higher mortgage rates, but massive government spending and the resulting drag on economic growth mean that borrowing rates will likely remain low for a long time.”

[Dale Jackson - BNN Bloomberg]

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

💌: Hello@WeAreHome.ca

📞: 647-838-5452

𝗠𝗼𝗿𝘁𝗴𝗮𝗴𝗲 𝗱𝗲𝗳𝗲𝗿𝗿𝗮𝗹𝙨. Will this 𝙞𝙣𝙘𝙧𝙚𝙖𝙨𝙚 𝙞𝙣𝙫𝙚𝙣𝙩𝙤𝙧𝙮 in the market 📈?

As of July 30, there was $170M in mortgage deferrals on record. It has been reported that about 85% of Canadians are 𝘯𝘰 𝘭𝘰𝘯𝘨𝘦𝘳 𝘪𝘯 𝘯𝘦𝘦𝘥 𝘰𝘧 𝘮𝘰𝘳𝘵𝘨𝘢𝘨𝘦 𝘥𝘦𝘧𝘦𝘳𝘳𝘢𝘭 𝘢𝘴𝘴𝘪𝘴𝘵𝘢𝘯𝘤𝘦.

There is plenty of speculation that we may see financially distressed properties come to market 6-9 months after the mortgage deferral was issued. Remember that if sellers were financially stressed, they would likely list their property for sale before the 6-9 months deferral has expired, which would mean we should see an increase in inventory in the fall. We will continue to be in a restricted market with lower inventory, so most listings will still sell for market value.

A Sept. 9 note by RBC Economics suggested that many Canadians had already resumed mortgage payments by the end of July. Among the country's six major banks, 12.4% of mortgages were deferred, down from 15.2% at the end of April, wrote RBC senior economist Josh Nye.

𝗗𝗜𝗗 𝗬𝗢𝗨 𝗞𝗡𝗢𝗪?

✖️72% of mortgage holders expect that they will have no difficulty making their mortgage payments.

✖️23% of homeowners expect some difficulty in paying their mortgage.

✖️5% expect a high degree of difficulty.

𝗦𝗼, 𝗶𝘀 𝘁𝗵𝗲𝗿𝗲 𝗮𝗻 𝗼𝗽𝗽𝗼𝗿𝘁𝘂𝗻𝗶𝘁𝘆 𝗶𝗻 𝘁𝗵𝗲 𝗺𝗮𝗿𝗸𝗲𝘁?

𝙔𝙀𝙎. Condo inventory is increasingly shifting the market into the buyer's favour.

Overall, we are seeing historically low interest rates for mortgage borrowers in Canada, which has proved to be a key driver in the housing rebound stemming from the global pandemic. These all-time low rates are helping Canadians not only get into homeownership at lower costs but also refinance their existing debt into lower rates, which are helping save thousands of dollars in interest expense.

[Data collected from the MPAC August Survey and Statistics Canada]

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

💌: Hello@WeAreHome.ca

📞: 647-838-5452

𝗔 𝘀𝗶𝗱𝗲 𝗲𝗳𝗳𝗲𝗰𝘁 𝗼𝗳 𝗖𝗢𝗩-𝟭𝟵 𝗶𝘀 𝘁𝗵𝗲 𝗻𝗲𝗲𝗱 𝗳𝗼𝗿 𝗺𝗼𝗿𝗲 𝘀𝗽𝗮𝗰𝗲.

Working from home is causing buyers to reevaluate their home needs. What once was a comfortable fit may be a little bit more of a 𝘵𝘪𝘨𝘩𝘵 squeeze.

We see a trend of buyers moving up sooner than expected to accommodate their changing work environment.

“According to Statistics Canada, businesses that expect their employees to continue working from home include the information and cultural industries sector (47%) and the professional, scientific and technical services sector (44.5%). The survey results also found that 25% of Canadian business are 'likely' or 'very likely' to offer their employees the option to work remotely following the pandemic, while 14% reported that they will make it a requirement.” [Toronto Star - More Canadians will be working from home post-pandemic, StatCan data suggests]

If you are thinking about moving up, the GTA can offer more options than before if you are expecting to be telecommuting to work.

𝗔𝗩𝗘𝗥𝗔𝗚𝗘 𝗣𝗥𝗜𝗖𝗘𝗦 𝗜𝗡 𝗧𝗛𝗘 𝟰𝟭𝟲 𝗙𝗢𝗥 𝗔𝗨𝗚𝗨𝗦𝗧

𝗗𝗲𝘁𝗮𝗰𝗵𝗲𝗱 𝗵𝗼𝗺𝗲: $1,505,100

𝗦𝗲𝗺𝗶-𝗗𝗲𝘁𝗮𝗰𝗵𝗲𝗱 𝗵𝗼𝗺𝗲: $1,166,226

𝗧𝗼𝘄𝗻𝗵𝗼𝗺𝗲: $834,222

𝗖𝗼𝗻𝗱𝗼: $673,174

𝗔𝗩𝗘𝗥𝗔𝗚𝗘 𝗣𝗥𝗜𝗖𝗘𝗦 𝗜𝗡 𝗧𝗛𝗘 𝟵𝟬𝟱 𝗙𝗢𝗥 𝗔𝗨𝗚𝗨𝗦𝗧

𝗗𝗲𝘁𝗮𝗰𝗵𝗲𝗱 𝗵𝗼𝗺𝗲: $1,088,559

𝗦𝗲𝗺𝗶-𝗗𝗲𝘁𝗮𝗰𝗵𝗲𝗱 𝗵𝗼𝗺𝗲: $784,952

𝗧𝗼𝘄𝗻𝗵𝗼𝗺𝗲: $719,667

𝗖𝗼𝗻𝗱𝗼: $540,491

-

If you have any questions about the market, please do not hesitate to reach out. Our team is happy to consult on your current situation and provide a curated plan based on your goals.

💌: Hello@WeAreHome.ca

📞: 647-838-5452

𝗗𝗢 𝗬𝗢𝗨 𝗢𝗪𝗡 𝗔 𝗦𝗛𝗢𝗥𝗧-𝗧𝗘𝗥𝗠 𝗥𝗘𝗡𝗧𝗔𝗟 𝗨𝗡𝗜𝗧 𝗢𝗥 𝗧𝗛𝗜𝗡𝗞𝗜𝗡𝗚 𝗢𝗙 𝗔𝗗𝗗𝗜𝗡𝗚 𝗢𝗡𝗘 𝗧𝗢 𝗬𝗢𝗨𝗥 𝗣𝗢𝗥𝗧𝗙𝗢𝗟𝗜𝗢? 𝙔𝙤𝙪’𝙡𝙡 𝙬𝙖𝙣𝙩 𝙩𝙤 𝙧𝙚𝙖𝙙 𝙩𝙝𝙞𝙨!

𝗥𝘂𝗹𝗲𝘀 𝗮𝗿𝗲 𝗰𝗵𝗮𝗻𝗴𝗶𝗻𝗴 📢